Investment conditions

Growth (economic)

The economic outlook is mixed, but generally positive. Economies are growing, although more slowly than long-term growth rates. Inflation is falling but is generally higher than central bank targets. Unemployment is rising in some economies but remains near record lows.

GDP figures vary depending where you look. US GDP growth – whilst still positive – slowed to 0.4% in the first quarter of 2024. This was below estimates and significantly slower than the 0.8% figure in Q4 2023. Japan’s economy shrunk more than expected at -0.5%. On the positive side, China’s economy continued to recover, posting 1.6% GDP growth in the first quarter. The UK and Eurozone have exited technical recessions posting positive GDP figures at 0.6% and 0.3% respectively.

Inflation continues to fall in most economies. In the US, inflation fell from 3.4% in April to 3.3% in May, UK inflation fell from 3.2% in March to 2.6% in April. Eurozone inflation increased from 2.4% in April to 2.6% May. All based on the latest available Consumer Price Indices “CPI”. The Federal Reserve’s preferred measure of US inflation – the Personal Consumption Expenditures (PCE) price index – has plateaued at a level of 2.7%, which calls into question whether the US central bank will start cutting interest rates anytime soon.

Looking forward, leading economic indicators such as the composite Purchasing Managers’ Index (PMI) – monthly surveys of company executives on business conditions – suggest economic expansion is ahead. In May, PMI figures were: 54.5 in the US, 53 in the UK, 52.6 in Japan and 52.2 in the Eurozone. Consumer confidence and retail spending indicators have started to turn down.

Putting this all together, although there are signs of a slowing global economy, the committee does not see a significant threat of a global recession any time soon.

Interest rate & liquidity environment

Some developed market central banks have begun reducing interest rates (Europe, Canada, Switzerland, Sweden). These cuts come on the back of inflation drifting down to target levels. There are question marks over when the US Federal Reserve will start cutting interest rates given robust employment figures and economic growth, and lingering inflation. In the UK, the Bank of England is expected to wait until after the election on 4 July before they start cutting rates. The outlier is Japan, where rates are starting to rise, given rising inflation and economic growth.

The path for rates after the first round of cuts is unclear, as central banks have to tread a fine line between loosening policy before inflation is truly vanquished and choking their economies by leaving rates too high for too long.

With global inflation continuing to fall, the committee are of the view that we have entered a broad-based rate cutting cycle (with the exception of Japan), but questions remain as to the speed and size of these cuts.

Valuations & earnings outlook

Corporate earnings continue to be strong, although analysts have been tempering their 2024 expectations slightly. There is a strong consensus for higher earnings growth in 2025, especially in the US and emerging markets. Valuations look fair in most geographies, with only the US looking expensive, and Europe and the UK looking relatively cheap.

Analysts are expecting 9.8% global earnings growth for 2024, and 13% for 2025. Within that, emerging markets have the largest expected earnings growth rates, 20.8% and 15.5% in 2024 and 2025 respectively. The UK and Europe are expected to return to healthy earnings growth in 2025, at 8.3% and 10.3% respectively. US earnings growth has been revised down in 2024, but still remains at a robust 10.4%, but for 2025 this is forecast to rise to 14.4%.

The US is still the only major stock market that looks expensive relative to its history, but this is because there are some very large companies that are very expensive. Some areas of the market are a lot cheaper than others and may provide better value for investors in our view. Europe, UK and China are currently trading below their long term average multiples.

Sentiment / flows

Based on market data and investor surveys, market sentiment and positioning look neutral, on the whole. Even though stock markets have positive momentum – trading above their moving averages – this is not extreme. Investors are neither paying for protection nor adding risk in the options market, which can signal negative or positive sentiment respectively, and investor sentiment surveys are neutral. US stock market volatility, as measured by the VIX index, is near its all-time lows, signalling calm for now.

Flows into financial market assets have been positive lately and this applies across asset classes. This is based on ETF inflow and outflow data.

Views by asset class

Equities

Stock markets have continued their upward march in 2024 to date. As has been the case for a while now, the largest gains have come from US technology stocks (see Nvidia, up 170% in 2024 to date).

Although we have some exposure to the US technology sector, and so have benefitted from this positive performance, the committee have been concerned about how expensive this area of the market has become and, in an effort to safeguard investor capital, the committee continues to diversify into other areas of the US stock market for diversification.

Outside the US, we have exposure to the UK, Japan and emerging market stock markets. The committee remained comfortable with these geographical exposures, but has decided to slowly start increasing our allocation to European stocks, concentrating on smaller companies with growth characteristics. This addition will be funded by taking profits on some of our US stocks. Within UK equities, the decision was taken to increase exposure to larger companies with growth characteristics, whilst reducing exposure to smaller companies which have performed well as the UK economy has recovered.

Government bonds

After a challenging two years for government bond markets, pressure is starting to abate as inflation falls back to target and interest rates start to fall. There is still a risk though that inflation stalls or starts turning up again, and rates don’t fall as fast as some expect. As a result, the committee decided to maintain our exposure to government bonds.

Within our government bond exposure, the committee decided to reduce our long-dated US government bond position and increase our UK government bond position. This decision was based on the belief that the Bank of England may be forced to reduce interest rates further and faster than the US Federal Reserve, given a weaker economic outlook and inflation falling relatively faster in the UK than in the US.

Corporate bonds

Corporate bonds have continued to perform well and support client portfolios. The committee recognised this positive performance and decided to take some profits. The proceeds from these sales will be used to increase the exposure to UK government bonds mentioned above.

Alternatives

What we want from this asset class is a return stream for portfolios that is uncorrelated to listed stocks and bonds, and therefore can provide key protection in times when stocks and bonds are moving down together, which has happened several times recently. We are still positive on alternatives, given this useful portfolio role.

Within alternatives, we have exposure to commodities through a broad commodity index fund and direct holdings in copper. We think copper will be integral in an electrified future, but there hasn’t been enough investment into new supply so you could see prices rise as the resource becomes scarce.

Gold and gold mining shares also feature in this part of the portfolio. Gold can provide a safe-haven in periods of geopolitical trouble. We have seen the central banks of countries which are less friendly with the US start to buy gold in large quantities, possibly to reduce their reliance of the US dollar. Gold miners are significantly undervalued in the committee’s opinion, given where the gold price currently is. These provide a more sensitive way to have exposure to the gold price.

The rest of the alternatives bucket is made up of a range of different funds and strategies which aim to benefit from economic volatility or move to a different drumbeat than traditional asset classes, thereby providing portfolio diversification.

Summary of positioning

Below is a summary of our views for each asset class, from strongly negative (- -) to strongly positive (+ +).

Asset Class

| Asset class | -- | - | Neutral | + | ++ |

|---|---|---|---|---|---|

| Equities | X | ||||

| Government bonds | X | ||||

| Corporate bonds | X | ||||

| Alternatives | X | ||||

| Cash | X |

Asset Class Breakdown

| -- | - | Neutral | + | ++ | ||

|---|---|---|---|---|---|---|

| Equities | USA | X | ||||

| UK | X | |||||

| Europe | X | |||||

| Japan | X | |||||

| Asia ex-Japan | X | |||||

| Emerging markets | X | |||||

| Bonds | Government | X | ||||

| Index-linked | X | |||||

| Investment grade | X | |||||

| High yield | X | |||||

| Emerging market | X | |||||

| Convertibles | X | |||||

| Structured credit | X | |||||

| Alternatives | Commodities, gold + miners | X | ||||

| Macro hedge + other alts | X |

Investment Committee Q&A

In this feature we attempt to lift the lid on the process and our views by interviewing one of the decision-makers: Andrew Fleming: Chairman of Saltus Asset Management and the Asset Allocation Committee

The Committee last met two months ago, what has happened since then?

Riskier assets like equities and credit within fixed income have generally been producing reasonable above cash returns, continuing 2023’s strong run. Within equities, Japanese stocks have given back some of their outperformance of last year and Chinese stocks have performed better, after three very poor years. The big trend in equities, however, continues to be strong performance from the US, larger companies in general and technology in particular. Given the importance of central bank policy in this cycle, there has also been a recent US Federal Reserve FOMC rate-setting meeting.

What has been driving investment markets in this period?

The central issue for all markets is the avoidance of a US recession, combined with clear signs that inflation continues to ease. Financial markets have been acting on this basis, but this view had important support from last week’s Federal Reserve rate setting meeting and press conference, which painted a picture of continued strong growth combined with moderating inflation. Goods inflation continues to be very well behaved, driven by China exporting deflation with, for example, Chinese imported goods prices into the US falling 2.0% yoy in May. The problem has been services inflation which has been much stickier, but here too there is evidence from sectors like rents and car insurance that financial markets are correct to anticipate further moderation in inflation, supported by Federal Reserve guidance. It is worth repeating that this continues to be a highly unusual cycle by post-1945 standards when previously, the norm has been central banks raising interest rates to choke off inflation, effectively inducing a recession. This cycle has been characterised by no recession, in spite of last year’s inverted yield curve and the market consensus indicating one was imminent, and continued strong economic growth as US companies demonstrate a general ability to deliver strong productivity growth and cope with higher interest rate costs. Decreases in central bank interest rates in China, Sweden, Canada, a raft of emerging market countries and significantly the ECB provides further recent evidence that this is an unusual cycle as it has historically always been the US Federal Reserve that leads on timing of interest rate increases. As recently as January, the consensus was for 7 US interest rate cuts this year on expectations for a likely recession. Federal Reserve and market expectations are now for only one or two cuts by year end.

What has been working well for our portfolios, and what has been less effective?

Full weightings in equities in portfolios have been very helpful, as have holdings in investment grade credit. Duration has recently been positive as fixed income markets liked the tone of central bank statements and policy actions. Within equities, our long-standing bias to quality companies with strong balance sheets and ability to maintain margins and deliver secular growth continues to be very positive. An overweight in Japanese equities has recently been less positive, as has an overweight in smaller and medium sized companies. It is the largest companies in the US that continue to outperform, particularly in the technology sector, although smaller companies are performing relatively better in the rest of the world, including recently in the UK. The principal detractor has been our commodity overweight, which has been impacted by what looks now, with hindsight, a reaction to a spike in prices based on technical moves in futures markets and disappointment towards the lack of a stronger pro-growth stimulus from China and, for gold, the disappearance of policy buying from India, Turkey and China, following several years of consistently strong purchases.

What decisions have the committee been making, due to the changing macro-economic conditions?

We have been focussed on getting the big picture right and as recent data has been supportive of our key call of no recession and steady economic recovery made last year, we have been making few if any significant changes to our positioning. At the margin, we believe UK growth will continue to disappoint and are adding to gilt duration at the expense of US bonds and putting more emphasis on larger UK companies in equities, following a period of smaller company outperformance, particularly as sterling will weaken if UK interest rates are cut. We are monitoring employment trends in the UK particularly closely.

Central banks across the world have started to cut interest rates, how do you see the path for cuts from here?

If inflation continues to moderate as we expect then we will see more cuts in interest rates. The interesting one is the UK where we would be looking for cuts, but the Bank of England has never cut rates in an election campaign, at least in the ‘post independence’ era. That said, if it did happen, and we think the odds are against it, it would be consistent with our observation that this is a highly unusual cycle. In the medium term, central banks clearly want to ease, where possible, to improve growth and given increasingly high levels of debt, but they also know they need to preserve some firepower to be able to lower rates meaningfully into the next recession, so they will be reluctant to be too hasty. The key remains inflation. It is also worth remarking that if the Federal Reserve did start signalling more interest rate cuts than currently anticipated and growth remained reasonable to strong, there is a very strong probability of a ‘melt up ‘ in US equities, even after the strong gains of the last couple of years.

US stock markets keep hitting record highs, do you think this can be sustained?

The US is a remarkably resilient economy which has demonstrated again in this cycle an amazing ability to deal with rolling recessions across different sectors and an ability to redeploy investment from unproductive sectors to productive ones. The US stock market is expensive by historical standards, but it deserves to be, and we do not think it to be outrageously expensive. Corporate margins remain effectively at record highs, productivity growth is strong and showing signs of acceleration, and forward looking estimates of profitability are positive led by larger companies. Historically, this would be the stage in the cycle when smaller companies would be outperforming. In the US, at least at the moment, this just isn’t happening, which we find intriguing. Our analysis increasingly appears to point to many of the most attractive smaller companies remaining private for longer, combined with private equity buying the best growth companies from public markets. If this is correct, then stock market returns could continue to be led by larger companies for some time to come.

The Japanese yen has been the worst performing developed market currency for almost two years now, do you see a change in fortunes for the currency?

It is fair to say the committee is divided on the yen. The Japanese currency is undoubtedly cheap, which explains why inbound tourism to Japan is so strong, but capital flows continue out of Japan. I would tend to focus on how all currencies have been relatively weaker against the US dollar which continues to experience strong capital inflows driven by better positive interest rate differentials, but mostly by investors wanting to participate in the remarkable US capitalist economic machine.

Commodity markets have stalled of late, do you still see these as a useful tool for portfolio construction?

Commodities are a very useful diversifier in portfolios, particularly as hedges against inflation, and they have been very helpful for us over the last five years. We see strong medium term demand and limited new supply for key energy transition metals like copper, although we are acutely aware of the substitution risk if new technologies for energy transmission were to appear. Gold and precious metals are important hedges against a potential debasement of fiat paper-based currencies in a world of increasing amounts of debt, but of course pay no interest. Recent price pullbacks appear to be based on technical futures trading. That said, these are also a timely reminder of just how much pricing in all markets, and not just commodities, are driven by short term and algorithmic traders.

UK equities are gaining more attention for the first time in a while, do you see opportunities here?

Our view on the prospects for UK equities has been unexciting for some time. Outflows out of UK equities from domestic investors continue relentlessly with wealth managers following the well worn path of UK pension funds selling equities to buy bonds to match liabilities. The UK market is undoubtedly cheap, but this largely reflects the composition of quoted companies, particularly in the FTSE 100, where there is very significant representation from large ‘value’ companies in sectors demonstrating little in the way of sales or profit growth. If the UK market is looked at on a sector adjusted basis, it is much less obviously cheap. Traditionally UK active managers have found the historically large pool of small and medium-sized companies a happy hunting ground for outperformance. Recent performance from smaller and mid sized companies has recently been better, but we are concerned about the ever shrinking pool of attractive quoted growth companies as ever more are taken over by trade buyers or private equity. Similarly, the medium term GDP growth outlook for the UK is lacklustre, which would cause us to be cautious on smaller companies, which tend to be more exposed to domestic sales and revenues. Bottom line is the UK is cheap, but we would need to anticipate better prospects and identify stronger catalysts for us to materially change our view.

How does the committee view upcoming elections and potential portfolio impacts?

We are obviously in the middle of a UK general election campaign. As with the US, markets continue to focus on the growth, inflation and central bank policy outlook and largely ignore the politics. As long as a capitalist rules-based system prevails in the ‘western world’, then this will remain the case. UK financial markets have effectively been unmoved by the campaign. The problems from the politics come when ‘shocks’ occur. Again, the key economy is the US. So far, financial markets have largely ignored the politics and anyway it is very difficult to know how to discount events. The best example is how well the US stock market performed in the ‘first’ Trump presidency. The US presidential election will undoubtedly be a very close affair, but US-based betting venues are indicating a rising probability of a Trump win in November. There are some signs of falling consumer confidence among Democratic party voters, which may be feeding into slightly weaker economic data in the US. The most interesting recent events around an election is in France. The announcement of parliamentary elections was undoubtedly a surprise following the EU elections. The French bond market has reacted badly with 10 year yield spreads over German bonds widening to the level last seen in the eurozone government bond crisis of over ten years ago. This move reflects the growing electoral success of the far right parties, against a background of many years of rising debt to GDP ratios in France, as well as the traditionally fiscally weaker countries of ‘southern’ Europe. Looking forward it is likely that volatility around politics will rise along with a tendency to extremism, given current and projected debt and debt servicing levels as governments and electorates face difficult trade offs against a background of continued high levels of immigration in the US and Europe and increasingly elderly demographics.

Manager in focus: UBS Global Equity Long/Short Fund

Summary

The UBS Global Equity Long/Short Fund is a global equity strategy, with a fundamental value investing style, one in which managers try to select stocks that are cheaper than they should be. The fund is focused on capital preservation, and has a fantastic long term track record of performance. Since its launch in 2012, the fund has only had one negative calendar year, and has returned over 5% per year on average (after fees), with a low correlation to global stock markets.

The fund is a long/short fund with a value-focused strategy, meaning the managers try to exploit mispriced stocks by selling stocks they deem expensive, whilst simultaneously buying stocks they deem cheap.

The fund uses a ‘multi-sleeve’ approach. There are seven different portfolios being run by seven sector specialists, all within the one fund. The fund’s allocation to each of these sleeves is then determined by two senior portfolio managers. This reduces the key-person risk (the risk that the lead portfolio manager leaves the firm), and it also increases diversification within the fund as the seven sleeves perform differently from each other.

This fund makes up part of our allocation to alternative investments, and plays a key role in providing diversification to portfolios as the fund should perform positively regardless of market direction.

What are equity long/short funds?

Equity long/short funds employ an investment strategy in which the manager takes both long and short positions in specific stocks. This strategy is designed to maximise the upside from markets, while limiting the downside risk.

Being long a stock means owning it outright and benefitting from any price appreciation. If you are short a stock, you are aiming to benefit from its price falling. Investors do this by borrowing the stock and selling it in the market. The idea is that the stock price falls, so the investor can buy back the stock at a lower price, and return it to whoever lent them the stock.

The manager of a long/short fund will try to identify and take long positions in undervalued stocks, whilst selling stocks they believe to be overvalued. Long/short funds have a wider investment universe than long only equity funds as they can take advantage of falling stock prices.

Most long/short funds have a long bias, meaning that they have more exposure to rising stocks than falling stocks. This strategy is a great way to reduce downside risk, and to exploit mispriced opportunities in the stock market.

Investment philosophy and process

The fund’s investment philosophy and process draws from UBS’ Global Intrinsic Value framework, which has a successful and proven 40 year track record. UBS estimates the intrinsic value of a company (what they think it is worth) by assessing the factors that drive a company’s future cash flows. They then compare this intrinsic value to the current market price. If there is a significant discrepancy between these two values, they decide whether to try and exploit this.

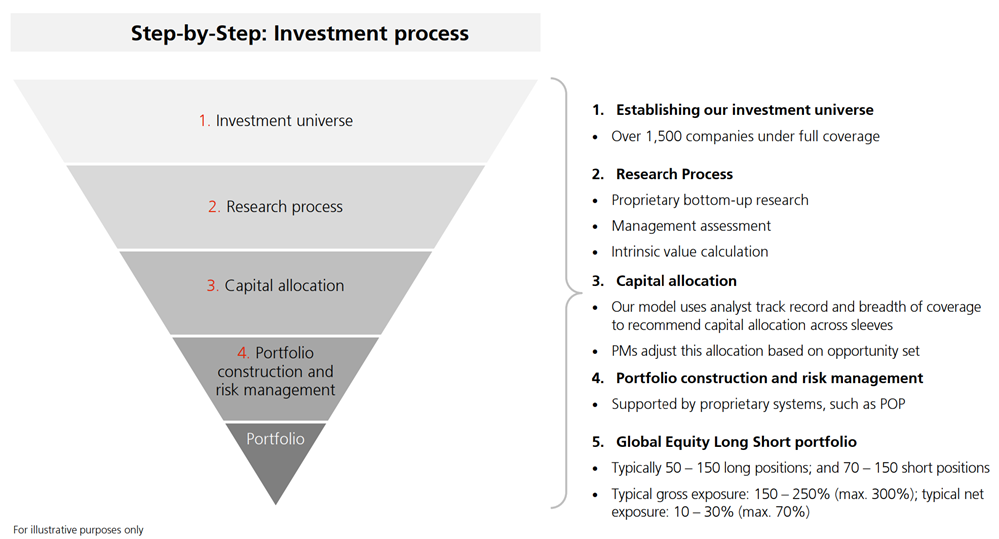

The fund uses an established, bottom-up investment process with five stages.

The first stage benefits from UBS’ large network of global research teams. There are 25 analysts contributing to the Global Equity team based in seven major cities, who together cover over 1,500 companies. During the second stage, investment ideas are put through a four-step research process in order to select the best ones. The third stage determines how capital is allocated between analysts and sleeves, which then is combined with the portfolio managers’ judgements about current market conditions. The last stage is building the portfolio and the ongoing risk monitoring. The fund typically holds 50-150 long equity positions, and 70-150 short equity positions. The fund will always have a net long exposure of around 10-30%, meaning it has a bias towards stocks rising in value. The investment universe is broad, and includes emerging market equities.

Performance

The investment objective of the fund is to preserve and grow capital, with low volatility. Historical returns have been driven by finding alpha (outperformance versus the market) with good downside protection.

There has only been one calendar year of negative performance since the fund launched in 2012. This came in 2018. The worst monthly loss has been -3.8% over that time. The fund has returned on average 5.1% per year since inception, with volatility of 5.6%. Performance has been consistent over the life of the fund.

Saltus Investment Case

- The UBS Global Equity Long/Short Fund provides our portfolios with diversification in both a wider portfolio context as it has a low correlation with stocks and bonds, but also within our alternatives allocation. This should help protect and grow our clients’ capital over time, regardless of market conditions.

- This lower-risk option helps us to gain exposure to stock market returns but with less risk than traditional equity strategies. This could be especially helpful if we enter a period of stock market volatility, which given the mixed outlook for inflation, interest rates, economic growth and geopolitics, may be close at hand.

- The fund is well-resourced being under the UBS umbrella, has a proven investment process, and has a strong performance track record of delivering on its investment objective.The multi-sleeve approach is attractive given that it reduces the risk of the important managers leaving.

Saltus use this fund as part of a diversified portfolio. This is not a recommendation to invest in this fund. Saltus will not be liable for any losses incurred as a result of investing in this fund.

Asset Allocation Committee

The committee consists of several senior members of the investment team, all partners, who invest their own money alongside clients. The committee is led by: