Investment conditions

Growth (economic)

Recent news has turned more positive. Energy prices have fallen, China has re-opened, inflation looks to have peaked and is falling. Estimates of economic growth have been revised upwards led by China, Emerging Markets and Europe. America’s economy is proving impressively resilient; in January, US retail sales rose the most in two years, with growth in all 13 retail categories, and after a jobs report far surpassing expectations, the unemployment rate hit a 53-year low. However, there is typically a circa 12-month lag between when interest rates rise and the full impact this has on the economy, so for this reason and others, the future path of economic growth remains highly uncertain, with estimates ranging from deep recessions across the globe, to no recessions at all.

Interest rate & liquidity environment

Policy hawkishness is still the main feature influencing markets. The central case amongst equity and bond investors appears to be that inflation has peaked, and that interest rates will fall in the second half of the year. Whilst the Fed continues to reduce liquidity, in the last three months, other central banks have provided significant injections of liquidity, particularly in China and Japan.

Valuations & earnings outlook

Reported corporate earnings have fallen over the last twelve months, but have not collapsed, and forecasted earnings imply a shallow recession. Many asset classes are trading more cheaply than historical averages, particularly in government bonds, small US companies, and non-US equities generally.

Sentiment / flows

Survey data indicates pessimistic but improving sentiment amongst investors, whilst actual investor positioning appears to be more positive than this. Stocks and bonds continue to move in the same direction, presenting an issue for those asset managers who rely on bonds to diversify their exposure to stock markets.

Views by asset class

Equities

On the back of positive economic news, equities have rallied strongly since October. However, the macro-economic outlook is still uncertain.

The asset allocation committee decided it was a good time to realise some short-term profits, by selling some equities that have recently bounced and redistributing the capital into other parts of the portfolio.

Data in the US shows its continued resilience, but this market remains significantly more expensive than others and, in our view, the lagged impact of rate rises has not been fully appreciated by investors. The committee decided to make various changes to our US equity positions, reducing our exposure to the overall stock market, as well as taking some profits on our exposure to smaller US companies, which had recently rallied. We slightly increased our exposure to larger cap growth stocks which, after a challenging 2022, now look more attractive.

We have for some time been tilting portfolios towards both the “value” and “income” styles, which has been very helpful for boosting returns compared to broad equity market risk. Some of this exposure is picked up by global companies listed on UK stock markets. The committee decided to maintain this style of investing and our exposure to those companies listed in the UK, whilst continuing to have significantly less exposure to the UK economy than many of our peers.

We remain unconvinced about the case for European equities, given uncertainties over many factors in the region. Because of the uncertainties, we decided to invest in a European equity manager that can generate returns from both rising and falling stock prices. This long/short equity manager has added significant value over time, and we feel is an excellent opportunity to enhance our risk-adjusted returns in an uncertain environment.

Although unconvinced that China has found a new growth model, its re-opening from covid lockdowns is undoubtedly positive for risk assets in Asia, and the committee decided to increase our exposure slightly, funded by the reduction in US equities.

Overall, we continue to tilt our equities towards quality companies (those typically more resilient when the outlook deteriorates), value companies (which are cheaper than the average stock so have a greater margin of safety in the price), and smaller companies (which are also trading more cheaply than the average stock).

Government bonds

Having avoided most of the drawdowns in government bonds last year, through 2022 the asset allocation committee had been investing in the asset class, attracted by the higher yields on offer. In the most recent meeting, the committee decided to increase the duration of our government bond exposure, because the higher yields now on offer should provide our portfolios with more protection against future economic uncertainty. Moving into a recessionary environment, the committee would expect to see a flight to safety, which the committee thinks would be positive for our holdings in government bonds. The committee noted that the performance of some inflation protected government bonds had recently underperformed non inflation protected bonds, and they decided to increase our exposure to the asset class, buying on the weakness, which we expect to add value over time.

Corporate bonds

Because yields on US corporate bonds had increased to attractive levels, we increased our exposure in a previous asset allocation cycle, and the asset class has performed particularly well this year. The committee decided to maintain this position. We continued adding to emerging market bonds, which are still trading at significant discounts, so they offer both high yields and the potential for significant capital appreciation. Emerging market bonds should also benefit if the dollar weakens from here, whereas other parts of our portfolio would benefit from a rising dollar, so the addition to emerging market bonds was supported by the potential diversification benefits.

Alternatives

Alternative asset classes can provide protection during market falls, with returns not correlated to the rest of the portfolio. For this reason, we are still positive on the on the asset class. However, the committee did make some changes to the underlying holdings.

We are still positive on selective macro hedge funds with an established record of doing well in volatile environments.

Our positions in various commodities continue to add value. They can provide portfolios with returns not correlated with the rest of the portfolio so provide useful diversification benefits. Many are under-supplied, but demand remains strong. Some commodities are sensitive to a deterioration to the economic outlook, so we remain vigilant, and prepared to trade commodities tactically as is often required with this asset class.

Overall, the environment is characterised by high uncertainty about the macro-economic outlook, so we remain cautiously positioned, but prepared to take advantage of opportunities that present themselves.

Summary of positioning

Below is a summary of our views for each asset class, from strongly negative (- -) to strongly positive (+ +).

Asset Class

| Asset class | -- | - | Neutral | + | ++ |

|---|---|---|---|---|---|

| Equities | X | ||||

| Government bonds | X | ||||

| Corporate bonds | X | ||||

| Alternatives | X | ||||

| Cash | X |

Asset Class Breakdown

| -- | - | Neutral | + | ++ | ||

|---|---|---|---|---|---|---|

| Equities | USA | X | ||||

| UK | X | |||||

| Europe | X | |||||

| Japan | X | |||||

| Asia ex-Japan | X | |||||

| Emerging markets | X | |||||

| Bonds | Government | X | ||||

| Index-linked | X | |||||

| Investment grade | X | |||||

| High yield | X | |||||

| Emerging market | X | |||||

| Convertibles | X | |||||

| Structured credit | X | |||||

| Alternatives | Commodities, gold + miners | X | ||||

| Macro hedge + other alts | X |

Investment Committee Q&A

In this feature we attempt to lift the lid on the process and our views by interviewing one of the decision-makers: Andrew Fleming: Chairman of Saltus Asset Management and the Asset Allocation Committee

The committee last met two months ago, what has happened since then?

The last two months have seen a general continuation of the rally in riskier assets which started in early October. Equities have moved higher as have corporate bonds. This trend has been confirmed within markets, with cyclical sectors generally outperforming more ‘defensive’ ones. Although we have positioned portfolios slightly under their neutral risk positions, we have generally kept up with the recovery through allocations to smaller capitalisation and higher quality equities, which have performed well.

What is the Committee's view on inflation?

We have been very consistent in highlighting that markets are all about the macro environment in general and inflation in particular. So far, the inflation ‘shock’ - and we need to recall that US consumer price inflation was close to zero as recently as 2020 - has focused on the actions of central banks to tighten policy to bring inflation down and prevent a 1970s inflation surge. So far, companies have managed to maintain margins and profits well in the face of higher interest rates, which is why equities haven’t fallen more than they have done. We are concerned though that the next phase of inflation will potentially threaten consumers' ability to spend, as wage rates are coming in well below inflation.

China has removed many of its covid restrictions, how significant is that for investors?

The Chinese economy has recovered in the same way most other economies ‘bounced’ after covid restrictions were lifted. This has been supported by the central bank’s very significant liquidity injections. Chinese equities have recovered strongly. We remain cautious on Chinese assets as we can’t identify a new growth model, but the liquidity creation is very helpful for trade and wider emerging markets and commodities.

Is global growth still slowing? Do you think we will see recessions, and if so, how severe are they likely to be in your view?

Our road map for this cycle has been clear for some time. We have been on ‘recession watch’ for nearly eighteen months, which is why we have been running a value and particularly quality bias in equities, which continue to serve clients well. The key issue remains whether central banks will need to raise interest rates more than currently anticipated, effectively inducing a recession to squeeze out the inflation threat. The shape of the US $ yield curve, which has now been steeply inverted i.e. longer rates are well below short rates, has in the past been a reliable indicator of recession. We are less convinced, as we believe there is in this cycle strong demand for longer dated high quality US government bonds, as there is a shortage of higher quality collateral to hedge futures and swap positions.

How are corporate profits holding up?

As before corporate profits have held up well in the face of higher input costs as a result of inflation and higher interest rates. The risk now is that consumption weakens as real incomes are eroded by inflation. In the USA, labour markets are strong, as is consumption. We think there are risks to both of these trends: corporations raised huge amounts of low interest rate debt in the 2018-22 period, so many are less exposed to higher short term rates, however, they will have to start refinancing in the coming period and there is still an overhang of excess savings from the covid lockdown periods that is boosting consumption, but is being eroded. There are two sectors we are particularly alert to profits risk: financials, given the shape of the yield curve and property, particularly given the likely costs of upgrading energy efficiency ratings over the coming decade.

Economic data seems hard to read at the moment, often with conflicting signals, what are the key things our Asset Allocation Committee is looking for?

Without wanting to sound complacent, we have read this cycle reasonably well so far, but there is huge uncertainty as to how it now plays out, with a wide range of potential outcomes with equally wide implications for markets. Overlaying everything is historically high debt to GDP ratios, which makes all the moving parts of a highly complex economy and central bank policy actions so difficult to read.

In periods of high volatility, sometimes great opportunities present themselves. Do any asset classes look particularly attractive in your view?

Markets are currently not particularly volatile, as they believe the US Federal Reserve can engineer a reduction in inflation without a hard landing recession. We think there is some complacency and, in the short-term, volatility may increase again as most of the hedge funds have closed out ‘short’ positions in equities.

How do Saltus manage currency risk in portfolios?

We don’t try to ‘manage’ currencies. Instead, I would describe our approach as being currency ’aware’, based on a valuation framework leaning into and out of emphasis, particularly as global investors against a client sterling currency base. If I can illustrate the point by describing how we deliberately allocated to US assets in the last two years as we thought the £ would weaken. Since the end of last year, we have thought the US $ would be more likely to weaken, so took an opportunity at an attractive entry point to switch our bond holdings to currency hedged share classes, which has been helpful as sterling recovered.

What lessons can be learned from history for how to interpret what's happening right now, and how best to manage portfolios in this environment?

I have been very consistent in saying this is a very different cycle to any seen in the last thirty years, which is the experience of most market participants. To me it looks much more like a 1945-2000 period cycle which was characterised by central banks having to tighten policy invariably inducing recessions to head off inflation. There is this central risk in this cycle, but to my mind it is immensely more complicated by the much higher debt levels mentioned earlier, the associated very high levels of house prices in most ‘western’ countries, all overlain with the growing geo-strategic hegemonic rivalry between the US-led world and China. There is clearly lots to worry about, but there is also a big risk to my mind that investors are still ‘anchored’ in a low interest rate/inflation world where ‘real’ interest rates are effectively the same as nominal interest rates. At current inflation rates, there is a real risk of inflation really eroding the real value of cash-like savings. There is a strong case for believing inflation in the next thirty years will be higher than the last thirty, which means investors will need to be careful to get exposure to real assets, like equities, with a history of protecting real inflation adjusted value over a cycle. The encouraging thing at the moment, to finish on a slightly more encouraging note, is we can see the early signs of a new central bank liquidity cycle into next year, even if the current environment is very uncertain.

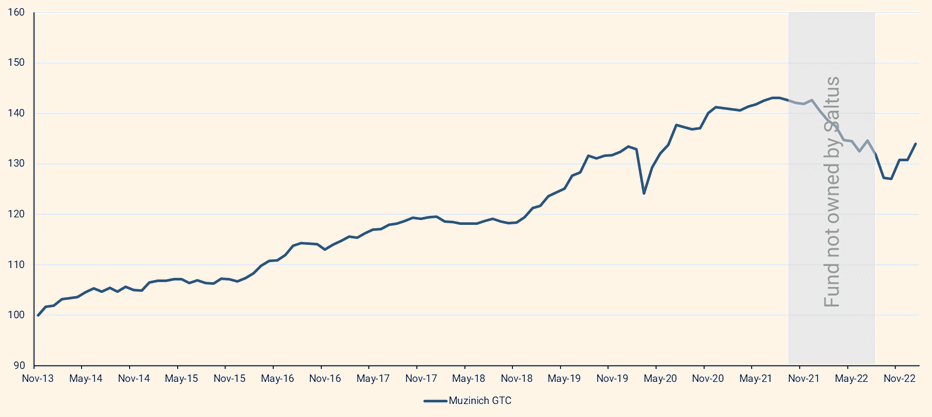

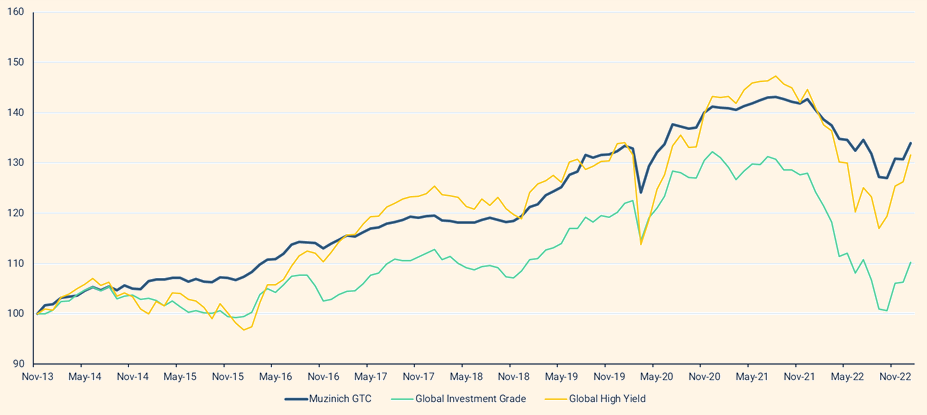

Manager in focus: Muzinich Global Tactical Credit

Saltus first invested in this fund in 2013, and because we were one of its earliest investors, we secured a lifetime discount. The Saltus investment team decided to sell it in 2021 because in their view, the yields on offer didn’t compensate our investors for the risk it posed. The fund then struggled throughout 2022 and, when the yield on offer increased to about 6%, we re-invested. The fund still yields around 6% and is a good example of how the opportunity set has changed, yields on many bonds are attractive again in our view.

Investment objective

This fund is an actively managed corporate bond fund seeking to generate steady risk adjusted returns over a market cycle, with a focus on global diversification, downside risk mitigation, and contained volatility.

Fund overview

The Muzinich Global Tactical Credit Fund dynamically allocates to high yield and investment grade securities, as well as senior loans, across the US, Europe and emerging markets.

The Fund seeks income generation with limited volatility:

- A “go-anywhere” fund with a global mandate across the rating spectrum

- A global credit fund, emphasizing absolute return that seeks to take advantage of return variations across credit sectors and the full economic cycle

- The flexibility to move in and out of global credit sectors, as well as up and down the credit and duration spectrums, seeks to give investors a competitive risk-adjusted return throughout the credit cycle

It has an investment process that relies on rigorous analysis of three pillars: fundamentals, valuations, and technicals.

Who are Muzinich?

They are privately owned, so can take a long-term partnership approach with their investors, without the short-term thinking that can dominate publicly owned finance companies.

They focus purely on credit, they don’t invest in any other asset class, and have built up an enviable reputation over 30+ years.

Investment offices in 14 locations globally so are close to the companies they lend to.

The Manager

Michael McEachern has 39 years of corporate credit experience, and is supported by a team of over 100 investment professionals all focused on corporate credit. Prior to joining Muzinich he was the president and Head of High Yield at Seix Advisors. He has a Degree from University of California, an MBA from Rice University and holds the Chartered Financial Analyst designation.

Source: Muzinich website.

Saltus investment case

Saltus originally invested in the fund for the following reasons:

- We had been looking for a reputable credit manager with experience of the asset class across many different countries, before we first invested in the Muzinich fund our credit managers were principally UK and US focused

- We were particularly excited by their investment process, which was designed to capture the majority of the upside during positive market environments whilst providing strong downside protection when the market environment deteriorated

- Saltus invested very early in the fund’s life, which is why we secured a lifetime discount. This may sound like a risky thing to do but Muzinich as a business had been running similar funds for 22 years, and the lead portfolio manager had vast experience in the sector, having been the founding partner of the high yield division at Seix Advisors, that grew to over $13 billion under his leadership, so we were very comfortable being an early investor

- Because we invested shortly after the fund was launched, we managed to secure a discounted fee which acts in perpetuity, so the discount applies even to new investors

Saltus had been holders of the fund for almost 10 years and were happy with its performance. However, in 2021 we decided that the yields offered by the asset class were too low to compensate for the downside risk of holding the fund, so we liquidated our position. When we sold in August 2021, it was yielding about 2%.

During late 2021 and into 2022, the downside risk we were worried about did materialise, and the fund saw a reduction in its value. As the credit market suffered in the market turbulence, the yield on offer from the fund rose to over 6% and we decided to re-invest into the strategy at these attractive yields.

Performance

We are pleased that since our initial investment, the portfolio (in dark blue) has kept up with the high yield bond market (in gold), but has protected on the downside like the more cautious investment grade bond market (in green).

Saltus use this fund as part of a diversified portfolio. This is not a recommendation to invest in this fund. Saltus will not be liable for any losses incurred as a result of investing in this fund.

Asset Allocation Committee

The committee consists of several senior members of the investment team, all partners, who invest their own money alongside clients. The committee is led by: