Investment conditions

Growth (economic)

The global economy remains resilient, economic activity is cooling, but so is inflation.

The key issue investors are grappling with is whether we will see recessions, and if so, what form those recessions will take. In our view, the likelihood of deep recessions has been reducing as the year has progressed, because economies have been cooling gradually rather than grinding to a halt as many predicted earlier this year.

Leading indicators are used to forecast future economic activity, one of the most popular being Purchasing Manager Indices (“PMIs”) which are monthly surveys of business executives who make orders for their companies. Readings below (above) 50 indicate economic contraction (expansion).

The latest PMIs for various regions are Global (48.8), US (49.4), UK (46.7), Japan (48.1), Europe (43.8), Emerging Markets (50.1). This data agrees with other readings we follow. Combined, they support the view of a gradual, managed slowdown, and that emerging market fundamentals are more positive than developed markets.

Headline inflation has been falling but prices remain high, reducing spending and excess savings. Excluding shelter costs, annual inflation in the US is now at the Fed’s 2% target. Headline inflation remains high in many countries, but the speed of price increases has broadly fallen, which is positive.

Recent Consumer Price Index (“CPI”) readings are 4.6% in the UK (6.3% last time we wrote two months ago), 3.2% in the US (3.7% two months ago), 2.9% in the Euro area (down from 4.3%), and 3.3% in Japan (up from 3.1%).

Inflation remains one of the key variables influencing Central Bank policy, economic growth (e.g., the likelihood of recession), and financial markets. Whilst positive inflation numbers mean price levels are still increasing, inflation appears to be getting under control.

Unemployment remains at or near historic lows in the UK (4.3%), US (3.9%) and Eurozone (6.5%). These numbers have increased slightly in recent months. UK unemployment is at half its peak post the 2008 Financial Crisis.

Looking ahead, the IMF expects global growth to fall from an estimated 3.5% in 2022 to 3% in 2023 and 2.9% in 2024, which is below the historical (2000-19) average of 3.8% but positive growth, nonetheless. It forecasts emerging and developing economies to grow more quickly than this, at 4.1% (2022), 4% (2023) and 4% (2024).

Interest rate & liquidity environment

Most major economies have been raising interest rates in an attempt to cool inflation. However, interest rates are not expected to move much higher because inflation has been falling. The risk of a policy mistake by Central Bankers is elevated in our view. Reduce rates too soon and inflation could rise again, as was the case in the 1970s. But keeping rates too high for too long could damage companies and consumers with high debt levels. This is a difficult balancing act, especially since the impact of higher rates generally takes 12 to 24 months to be felt.

Financial conditions and geopolitical risks have eased slightly, with oil, the US $, spreads, and yields falling back from highs. China is stimulating its massive economy while easing tensions with Western democracies.

Valuations & earnings outlook

At the global level, corporate earnings have been resilient, and higher than expected in many areas. Global profit margins have remained robust, despite rising prices and borrowing costs.

US companies remain significantly more profitable than other regions. Corporate earnings in the United States recently reached an all-time high, and analysts expect robust earnings growth next year. Earnings in the UK have been falling but analysts currently expect a recovery next year. For other developed markets, Japan is a standout performer for profitability, with corporate earnings expected to grow 10.7% this year, and 6.6% in 2024. Earnings within Emerging Markets have fallen this year, but analysts expect a strong recovery next year with +17.9% expected earnings growth for 2024.

The US stock market is the only major region that is meaningfully overvalued compared to history. Investors are prepared to pay more for companies listed in the US in general, and especially for those expected to profit most from new technologies (e.g., artificial intelligence). The UK stock market is very cheap compared to history, trading about 30% more cheaply than its 10-year average (price to earnings ratio).

Assessing the value of different asset classes compared to historical patterns indicate that investors are now pricing in a lower probability of recession than they did earlier this year. However, many assets are still trading significantly more cheaply than others, for example, smaller company stocks (especially the UK and mainland Europe) as well as many emerging and frontier markets.

Sentiment / flows

Predicted stock market volatility has been fairly low all year, the widely followed VIX index has rarely edged above its long-term average of 21 throughout 2023 (currently at 13). Readings above 30 generally indicate fears of large drawdowns in stocks. Stock market momentum is pointing upwards in many markets as investors have been more risk-on because economic conditions have turned more positive.

Views by asset class

Equities

Measures of global stocks show good gains year to date. However, returns have been flattered by a few very large companies experiencing very large gains, mainly attributable to expected revenue growth from artificial intelligence.

Mindful of how expensive these technology companies have been, and in an effort to avoid potentially large drawdowns from expensive stocks (as has happened several times over the last 50 years, most notably Nifty Fifty in the 1980s, and the dot-com bubble of the late 1990s), the Asset Allocation Committee has had less exposure to these companies than would have been optimal for clients.

Instead, the Asset Allocation Committee has been focussing on less expensive companies, those with greater margin of safety in their stock price. So far this year, this has detracted from performance, but this was done in an effort to safeguard investor capital. However, over the last few weeks, we have seen significant gains for non-tech companies. The breadth of stock market gains is much wider now than it was a few months ago, indicating more confidence, that higher interest rates are working to cool economies without causing too much damage, and that interest rates won’t need to rise much higher, if at all.

For some time now, the Committee has been tilting stock portfolios towards “quality” companies, those with stronger balance sheets and less volatile earnings, which has been very beneficial for portfolios. In the most recent meeting, the Asset Allocation Committee decided to further increase the “quality” of our stock positions, for even greater resilience, funded by a reduction in “value” companies.

Among developed markets, we express a preference for Japanese equities, given the ongoing accommodative policy, presence of negative real interest rates, and the implementation of shareholder-friendly reforms that are taking hold. Japanese equities have outperformed even US equities this year. The Committee decided to maintain this exposure which has been working well.

We had recently increased exposure to Asia, emerging markets, and frontier markets. This decision has contributed meaningfully to investment portfolios. Many of these countries are ahead of developed markets when it comes to growth and recovery, they haven’t had the same cost increases as some Western countries and have been trading more cheaply than many developed markets.

We remain unconvinced about the case for European equities, given uncertainties over many factors in the region, such as concerns about debt sustainability and weakness in Germany. Because of the uncertainties, our exposure to European stocks comes mainly via a long/short equity manager, because they can generate returns from both rising and falling stock prices.

Overall, we continue to tilt our equities towards quality companies (those typically more resilient when the outlook deteriorates), and smaller companies (which are trading more cheaply than the average stock).

Government bonds

The last two years has been the worst two-year period in 150 years for US government bonds, and UK government bonds have lost about a third of their value over the last three years (conventional all stocks UK Gilts fell -32% over three years). Attracted by yields of around 5%, the Asset Allocation Committee have been slowly increasing our allocations to both of these markets. If interest rates fall, (or if investors bet that they will) we should see significant increases in their value, as has happened over the last few weeks.

Corporate bonds

In recent Committee meetings, it was decided to increase our exposure to emerging market bonds, and corporate bonds. These have performed well since the decisions were made. In the most recent meeting, the committee decided to further increase our corporate bond exposures, which are yielding around 6%. Like the government bonds, if interest rates fall these should see significant gains (all else equal).

Alternatives

Alternative asset classes can provide protection during market falls, with returns not correlated to the rest of the portfolio. For this reason, we are still positive on this asset class. However, having avoided most of the large drawdowns in bonds (in our active portfolios), we believe bonds now offer better risk vs reward opportunities than some of our alternatives going forwards. The committee decided to continue our rotation away from low-risk alternatives in favour of bonds.

We have positions in broad commodities as well as copper, all of which look undervalued on a long-term view. We have some macro hedge funds that can add significant value in times of heightened volatility. We also have positions in gold and gold miners. Gold can provide meaningful protection when inflation surprises on the upside, and gold miners are significantly undervalued in our view.

Overall, the environment is characterised by high uncertainty about the macro-economic outlook, so we remain cautiously positioned, but prepared to take advantage of opportunities that present themselves.

Summary of positioning

Below is a summary of our views for each asset class, from strongly negative (- -) to strongly positive (+ +).

Asset Class

| Asset class | -- | - | Neutral | + | ++ |

|---|---|---|---|---|---|

| Equities | X | ||||

| Government bonds | X | ||||

| Corporate bonds | X | ||||

| Alternatives | X | ||||

| Cash | X |

Asset Class Breakdown

| -- | - | Neutral | + | ++ | ||

|---|---|---|---|---|---|---|

| Equities | USA | X | ||||

| UK | X | |||||

| Europe | X | |||||

| Japan | X | |||||

| Asia ex-Japan | X | |||||

| Emerging markets | X | |||||

| Bonds | Government | X | ||||

| Index-linked | X | |||||

| Investment grade | X | |||||

| High yield | X | |||||

| Emerging market | X | |||||

| Convertibles | X | |||||

| Structured credit | X | |||||

| Alternatives | Commodities, gold + miners | X | ||||

| Macro hedge + other alts | X |

Investment Committee Q&A

In this feature we attempt to lift the lid on the process and our views by interviewing one of the decision-makers: Andrew Fleming: Chairman of Saltus Asset Management and the Asset Allocation Committee

The Committee last met two months ago, what has happened since then?

Essentially, risk assets like equities and bonds have performed strongly. In the US, the S&P 500, for example, is up nearly 12% since the end of October and is now less than 5% below its all-time high, achieved in January 2022. As importantly, the market has broadened out as evidenced by the recent outperformance of the equal weighted S&P 500 index relative to the primary index - which is market capitalisation weighted and dominated by the largest, largely ‘tech’, companies - which powered returns earlier in the year.

What has been driving investment markets in this period?

Growing evidence that inflation is falling, and so markets can anticipate more clearly the end of the US Federal Reserve higher interest rate tightening cycle, combined with data showing the US economy will avoid a recession. This looks increasingly like a ‘soft landing’ for the economy and bonds, and equities, rightly, have really responded to this outlook. You need to remember the background to these moves. We have observed before that this has been the most anticipated recession in US history: the yield curve has been inverted (normally a classic indicator of recession) since the summer of 2022, leading indicators have been falling, interest rates have been raised sharply and the money supply as measured by M2 has been falling. Instead, the US labour market remains strong but is cooling, inflation is falling, oil prices are lower and housing rental growth is well off the top. All markets have recently been highly correlated as, to a large extent, everything is being priced off the key macro variables of inflation and economic growth, but movements within equity and bond markets are also confirming the ‘soft landing’ outlook. Credit spreads remain tight and equities with quality, growth and cyclical characteristics have been outperforming companies with ‘value’ and defensive characteristics in the US.

What has been working well for our portfolios, and what has been less effective?

The averaging-into-bonds-on-higher-yields-strategy, combined with holding good weightings in ‘quality’ equities and a more ‘global’ approach in the equity risk components of portfolios, have both worked very well. Of course, we could have had more bonds and more equities, but we have managed to be well paid for the risk we have taken in a highly uncertain period following a year like 2022, when we really preserved client’s capital. Again, as I have observed before, it is very difficult to get both the ‘sell’ and the ‘buy’ sides of a trade right.

The Committee feels this is a good environment for bonds, why is that?

We have been of the view through this year that inflation is likely to come down more than the consensus has anticipated and hence the strategy of buying bonds as yields rose. We are now more confident that inflation will moderate further in the US which will allow markets to anticipate cuts in short term interest rates later in 2024. This, combined with our view of no recession and ‘hard landing’, makes corporate bonds a much more attractive proposition to take advantage of the yield pickup.

If interest rates stay flat or fall, what’s the upside potential on the bonds?

We don’t anticipate yields falling much but there is an increasing reinvestment risk in holding ‘short duration’ cash through 2024, as the risk is Central Banks led by the US Federal Reserve and the ECB start to cut interest rates. If markets started to believe there was a high probability of inflation returning to a c2% ‘policy target’ then returns from longer dated bonds could be very significant. Overall, the environment for bonds is much more likely to resemble the ‘Old Normal’ period of the 1970s to 2008 before Central Banks collapsed interest rates after the global financial crisis of 2008/9 and in response to the Covid pandemic.

What happens if we are wrong and interest rates increase further?

If we are wrong on interest rates and bonds, it will be because inflation indicators start to rise again, which is likely to be a result of much stronger economic growth. The thing that causes us to be optimistic on inflation while economic growth remains resilient is the growing evidence of strong underlying productivity growth in the US, led by the positive benefits of technology. Non-farm productivity growth is now rising at an annualised rate of just over 5% which means real unit wage growth is falling slightly by c -1. In essence, US corporate profitability, the labour market and household consumption can all remain strong without (crucially) interest rates having to rise to choke off inflationary growth. Incidentally, the reason why we think inflation will be much stickier in the UK and why the Bank of England will be slower to cut interest rates is the continuing poor productivity record of the UK economy. If we are wrong on inflation, then bonds now provide much more of a cushion from running yields at current prices to protect against the possibility of interest rates rising and yield curves steepening than was the case last year. So, overall, a much more interesting each way bet with the balance increasingly tipped on the side of potentially much better returns if we are right on inflation and Central Bank policy.

What’s the Committee’s view on inflation?

Hopefully it is clear we think inflation will surprise on the downside. In addition to the underlying positive productivity story at the margin, China has returned to being an exporter of lower prices to the rest of the world. We have been long-standing China sceptics on the economy as the old growth model has run out of road in the face of over reliance on debt and residential construction and against a background of an ageing population. To us the recent Xi visit to the US is a sign that the Chinese economy is under real pressure. On inflation in the ‘West’, however, all this means that China will once again be ‘exporting’ their deflation to the rest of the world. We are watching though the recent signs of China’s attempts to stimulate the economy through liquidity injections closely.

How does the Committee view equities?

Broadly positive. The profit outlook looks reasonable for 2024 and corporate cash flow in the key US economy powers ahead. A resilient economy with no hard landing and well-behaved inflation, and hence no further Central Bank tightening, combined with the tail winds of fiscal stimulus and positive productivity growth means equity returns could be surprisingly good. Our slight caution is current valuations are not cheap and are above the sorts of levels normally associated with the start of a new ‘bull’ market. We do think that the equity market will be more broadly based than has been the case this year and, therefore, think this should be a much better environment for active managers.

Without naming specific investments because we haven’t traded yet, what does the Committee think is attractive about infrastructure?

It is not so much infrastructure as overall pricing of closed end funds where the quoted prices of these companies, in many cases, are trading well below net asset values. In the scramble for yield when interest rates were so low three or four years ago, a lot of funds were launched to offer investors bond-like yields based on holdings in infrastructure and alternative energy suppliers, like solar and wind. We didn’t participate in this, but now think there are some attractive opportunities among the wreckage.

As we near the end of the year it’s a good time to reflect on 2023. In terms of the Saltus investment team or financial markets, what will you remember about this year? What was accomplished? What lessons were learned?

I remember recalling when we last spoke, at the moment of shock associated with the Hamas attack on Israel and anticipation of the likely response, that I didn’t think there had been a year since 1945 when there hadn’t been a reasonably major conflict somewhere in the world. Just look at returns over the last eight or so weeks! So, as an investor, it is important to remember that the best returns often come when everyone is pessimistic and to own equities that take advantage of the human genius for invention and the ability of the market-based capitalist system to achieve productivity enhancing benefits and returns. I obviously remember the key calls of inflation peaking and no deep recession, as these have absolutely driven returns and movements within markets. For the investment team, it is pride in managing to navigate through a lot of policy and market uncertainty, getting better at anticipating changes that affect markets and our ability to manage portfolios across a very wide range of risk profiles and the additions to the range this year in income and sustainable strategies.

What are the major investment themes to watch in 2024?

The big potential shocks of 2024 are likely to be political in nature. Looking at the polling data, the probability of a Trump presidency in the US is surprisingly high. If this were to happen, his policy agenda is very clear and, unlike his first presidency, he appears to be much better prepared with key advisors and appointees in place to implement changes as quickly as the political system allows. This agenda looks very protectionist and isolationist so, if implemented, would be very damaging to the world’s open trading system and for the other, European, members of NATO who aren’t spending enough on defence. It would also embolden Putin and the Chinese Communist Party and encourage more geo-political turmoil and uncertainty. There is also the potential for turbulence associated with the sustainability of debt-financed growth in general and fiscal deficits and US fiscal deficit in particular. There was a mini bond riot in the summer with concerns about the US fiscal position but, given the scale of borrowing at a time when the US economy is strong, which normally is associated with cyclically strong tax receipts, there is the potential for a real hiatus over the coming years. To put this in perspective, the US Treasury needs to refinance 36% of the stock of public debt over the next 18 months, in addition to a $2 trillion fiscal deficit. The US does have the enormous advantage, or the ‘exorbitant privilege’ in the words of Valerie Giscard d’Estaing, of funding in US$ - still overwhelmingly the global financing and reserve currency - but this will be a big challenge. Other countries don’t have these advantages, including the UK which is running persistently wide trade and fiscal deficits. Similarly, there remains the potential for a Eurozone blowup over debt sustainability, one of the reasons we have low exposure to the region. Ukraine, the Middle East, and Taiwan all, of course, remain real potential flashpoints. Against all this, the climate continues to warm. I have followed the scientific literature for many years, but it is increasingly clear that we are very close to an irreversible tipping point on the climate on current policies. I don’t have the room to go into all the likely outcomes, but the potential for large parts of the world to become uninhabitable is alarmingly high with all the implications for migration and economic dislocation. It isn’t going away.

Manager in focus: Hermes Unconstrained

What are unconstrained credit funds?

An unconstrained credit fund is an investment fund with the flexibility to invest in a diverse range of credit-related securities, unrestricted by specific benchmarks. These funds can include corporate bonds, high-yield bonds, convertible bonds, loans, and other fixed-income securities. The “unconstrained” nature implies that fund managers can make investment decisions based on their assessment of market conditions, credit quality, and other factors, rather than being tied to a predefined index. This flexibility allows managers to adapt to changing market conditions, pursue diverse opportunities, and optimise returns. Investors in these funds seek to benefit from the manager’s dynamic allocation of capital, but it’s important to note that the lack of specific constraints can introduce higher levels of risk, relying heavily on the manager’s skill and judgment.

Who are Federated Hermes?

Federated Hermes provides investment products and services to institutional and individual investors globally. They manage assets across various asset classes, including equities, fixed income, real estate, and alternatives. The firm has a focus on responsible investing, integrating environmental, social, and governance (ESG) factors into their investment processes. Currently AUM for the business sits around US $669 billion.

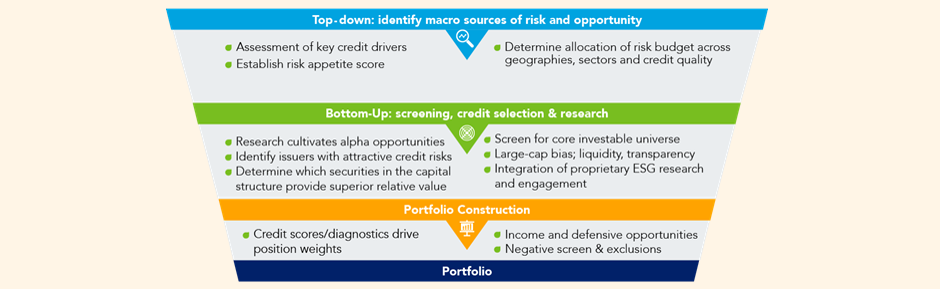

Investment Philosophy:

The team holds the view that optimal capital preservation and consistent returns with reduced volatility are achievable by pursuing global investments, spanning the entire capital structure, and encompassing various debt securities. They advocate for active management, grounded in a bottom-up, fundamental approach to investment selection within a top-down analysis framework. The team has ingrained their commitment to ESG, integrating strict criteria as an integral part of their process, and has documented their findings in a comprehensive white paper on the subject.

Diversifying issuer selection beyond the traditional realms of the US and Europe, and venturing into emerging markets, presents an enriched landscape of opportunities and broadens the spectrum of potential returns. By expanding the geographical scope of investments, the portfolio gains exposure to dynamic economies and emerging industries, fostering a more comprehensive and resilient investment strategy.

Moreover, the emphasis on security selection, complementing the process of choosing individual companies, becomes paramount. Conducting a thorough analysis of fixed income securities and their placement within the capital structure allows for strategic positioning that can unlock unique investment opportunities. This dual-layered approach, focusing on both the specific company and the intricacies of its capital structure, enhances the precision and effectiveness of investment decisions.

In addition to proactive security and issuer selection, a strategic focus on downside defence further contributes to the improvement of risk-adjusted returns. Prioritising measures to mitigate potential losses during market downturns is essential for maintaining the resilience of the portfolio. This approach aligns with a broader strategy of capital preservation, reinforcing the commitment to safeguarding investments even in challenging market environments. By integrating these principles into the investment strategy, the aim is not only to optimise returns but also to fortify the portfolio against potential downside risks.

Performance:

The fund has delivered solid performance this year, especially considering the significant volatility in interest rates. With a year-to-date performance of 7%, the fund has proven valuable in offering stability during periods of market volatility, particularly in the equity markets.

Yields in various segments of the global credit market are currently at their highest levels in more than a decade. This is a positive indicator for future returns, as historical trends suggest that the initial yield at which investors acquire credit assets is a strong predictor of their earnings in the following years. The heightened yields also offer credit investors a substantial buffer, providing valuable resilience to potential increases in volatility anticipated in the upcoming year.

Saltus Investment Case:

While many credit funds have not experienced growth in recent years, this Hermes fund has surpassed its peers in the sector.

The outlook for credit appears positive, and the fund manager, Fraser Lundie, boasts a lengthy and successful track record in the industry, earning high regard from our team and the wider industry.

The fund is strategically crafted to excel in actively traded credit markets, positioning it well for conditions similar to those observed in recent months.

The team has ingrained their commitment to ESG, integrating struct criteria as an integral part of their process, and has documented their findings in a comprehensive white paper on the subject.

Saltus use this fund as part of a diversified portfolio. This is not a recommendation to invest in this fund. Saltus will not be liable for any losses incurred as a result of investing in this fund.

Asset Allocation Committee

The committee consists of several senior members of the investment team, all partners, who invest their own money alongside clients. The committee is led by: