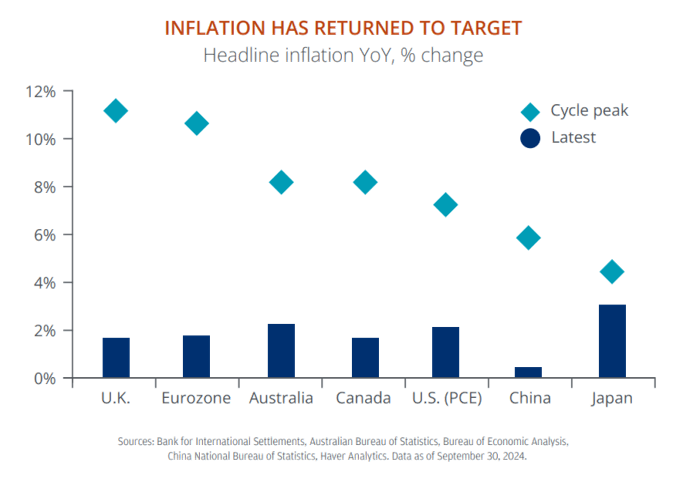

The past year has been remarkable for investors, with favourable economic conditions fuelling unexpectedly good equity market performance. Inflation has eased to manageable levels, economic growth remained robust, corporate profits soared, and central banks shifted to cutting policy rates.

As a result, global stocks delivered impressive returns whilst bonds had more mixed fortunes. At Saltus, our balanced multi-asset portfolios have returned over 15% in the year to November, demonstrating resilience in market volatility. [1]

Looking ahead to 2025, the outlook is promising. The strong market foundation set in 2024 offers a unique opportunity to build on that success. Now is the perfect time to consider whether different strategies and perspectives could help maintain growth within your portfolio.

Key themes

As we approach 2025, several key trends and considerations are set to shape investment decisions. Here’s a closer look at the themes likely to influence markets and how they could impact your portfolio strategy:

Central banks shift to growth support

With the global economy stabilising, central banks are cutting interest rates to encourage growth. These lower rates may have ripple effects on various sectors, from US housing markets to European productivity.

For investors, the question is whether to lean into past strategies for easing cycles, such as favouring cyclical assets like emerging markets, or to explore new opportunities that do well as growth slows such as growth equities.

An AI surge in capital investment

Companies and policymakers are driving an investment boom to capitalise on major trends. Artificial intelligence (AI), energy infrastructure, and security advancements are fuelling demand for significant funding. From the rise of robotics in daily life to the industries that could benefit from AI, these developments present exciting possibilities for growth.

Political shifts and their market impact

Following recent US elections and other global political events, investors are assessing how these outcomes might influence government debt, tax policies, and the broader regulatory environment. Growing interest in anti-competitive movements and antitrust sentiment may lead to shifts in market dynamics, making it critical to understand how these changes affect markets and sectors.

Strengthening portfolio resilience

With market volatility and economic uncertainty on the rise, building a resilient portfolio is more important than ever. This could involve diversifying into assets with a lower correlation to stocks and bonds such as commodities, volatility-based strategies or private assets, and putting a higher emphasis on strategies that protect against potential downturns whilst preserving upside participation.

2025: A balanced outlook

Whilst 2024 delivered some outstanding market gains, these are unlikely to be repeated in 2025. Elevated valuations, historically tight credit spreads, and ongoing geopolitical risks suggest a return to more trend-like portfolio growth.

At the same time positive forces, foremost of which is continued economic expansion, falling inflation and central bank rates, and solid corporate earnings, offer reasons for optimism.

We recommend maintaining a balanced approach, diversifying between growth and defensive strategies, and keeping flexibility to seize emerging opportunities. Sectors like private assets and alternatives may offer attractive avenues for growth and risk management, whilst holding some cash reserves could provide the agility needed to respond to market volatility.

The US: Navigating change and uncertainty

The US economy demonstrated remarkable resilience in 2024, with growth far exceeding expectations. As we look to 2025, a mix of opportunities and uncertainties will shape the economic landscape. Here’s a closer look at key factors influencing the year ahead.

In 2024, the US economy surprised many by growing 2.7%, well above earlier predictions of just 1%. For 2025, growth is expected to moderate slightly to just over 2%, driven by shifting dynamics. Consumer and government spending, which were vital growth drivers in 2024, are likely to slow, with investment spending stepping in to take a larger role.[2]

However, challenges remain. Consumers, especially those with lower incomes, are facing headwinds. Savings rates remain low, pandemic-era savings have been largely depleted, and real income growth is expected to cool. These factors could weigh on overall consumer activity in the coming year.

Source JP Morgan [3]

Policy shifts

The potential for new tariffs looms large as the US transitions to a new administration. President-elect Donald Trump has signalled a preference for wide sweeping and higher tariffs, which could affect businesses and consumers alike. Whilst any tariffs introduced in 2025 are likely to cause a short-term inflationary impulse, we are not currently expecting a return to 2021 levels. Another consideration is the potential rollback of multiple stimulus measures, like the Inflation Reduction Act and CHIPS Act. Whilst some funding has already been allocated, a portion remains exposed to policy changes. The impact of such rollbacks, whilst notable, is likely to be relatively small compared to broader CAPEX trends mostly notably, AI.[4]

Eyes on the data

The Federal Reserve remains focused on data-driven decision-making and is expected to continue lowering interest rates, at least in the short term. Trade uncertainties may create a temporary uptick in activity as businesses prepare for potential changes, but a slowdown could follow later in the year.

Additionally, employment trends bear watching. Companies may take a cautious approach post-election, leading to slower hiring. Tighter US immigration policies would constrain population and labour force growth, potentially driving up wages.

The year ahead presents more questions than answers. Predictions range widely, and the outcomes of key events, such as shifts in trade policy or potential tariff hikes, are far from certain. As observed in past election cycles, market reactions can be unpredictable, and concerns about rising inflation may give way to unexpectedly faster market declines.

What is the outlook for the S&P in 2025?

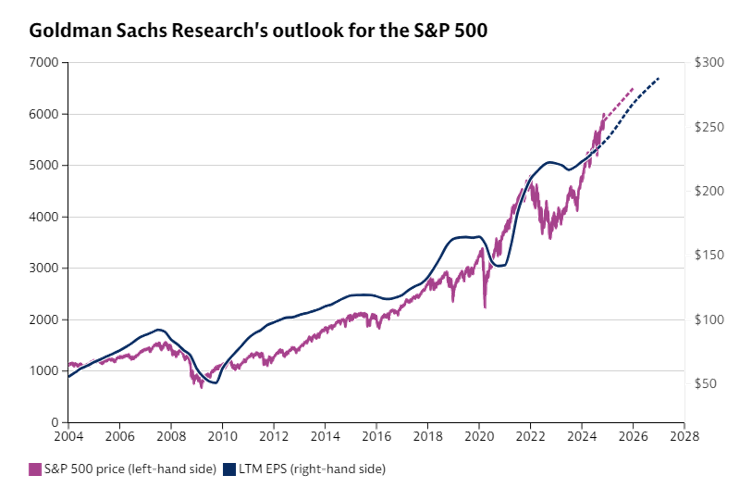

The S&P 500 is expected to show steady growth in 2025, with corporate revenues closely mirroring broader economic trends. Goldman Sachs Research forecasts sales growth of around 5%, in line with nominal GDP growth, supported by a projected 2.5% increase in real GDP and inflation cooling to 2.4% by year-end.[5]

However, this is unlikely to come without increased volatility. The incoming administration of President-elect Donald Trump is likely to introduce significant policy changes. Proposed tariffs on imported cars and select goods from China, alongside tax cuts, are expected to balance out in terms of their overall impact on corporate earnings.

Goldman Sachs anticipates S&P 500 earnings per share (EPS) to reach $265 in 2025 and $288 in 2026, in line with the median market consensus. These estimates, however, are slightly lower than the more optimistic bottom-up forecasts based on individual company estimates, which suggest EPS of $275 for 2025 and $311 for 2026. This represents EPS growth over 2025 of some 11%.

Whilst these expectations are measured, they indicate a stable and reliable growth path for the S&P 500, providing investors with an optimistic outlook for the year ahead.

Source: Goldman Sachs Research[6]

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

The UK market

Inflation in the UK is steadily declining, moving closer to the Bank of England’s (BoE) 2% target. Despite this encouraging trend, the BoE has only recently cut interest rates again since August to 4.75%. The decision reflects the central bank’s commitment to addressing lingering inflationary pressures in the economy.[7]

One factor helping to curb inflation has been the easing of energy prices, which had been a major driver of higher costs. However, there are risks that could disrupt this progress. Rising tensions in the Middle East could impact global oil supplies, potentially leading to higher energy prices. Closer to home, the UK’s energy price cap has recently been raised by around 10%, which may slow the downward momentum on inflation in the near term.

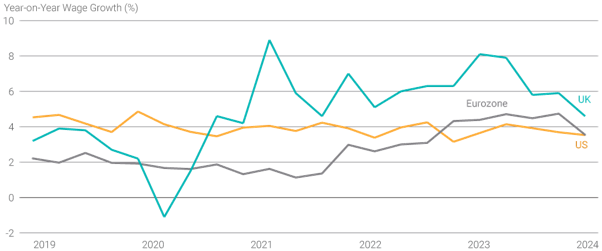

Another area of concern is wage inflation, which remains more pronounced in the UK compared to the US and the rest of Europe.[8] The chart below illustrates the year-on-year difference in wage growth across the UK, EU and US. Public sector wage increases above the rate of inflation are a major factor, keeping wage inflation elevated and contributing to broader price pressures.

Year on Year Wage Growth for Developed Economies

Source: FactSet [9]

What these insights mean for investors

Overall, our outlook on the UK market is mixed. Equity valuations remain very cheap on both a relative and absolute basis, but much of this poor performance can be attributed to sub-par earnings and GDP growth. With so many question marks surrounding the outlook of this market, and whether the new Labour government can deliver on its ‘pro-growth’ manifesto, we continue to maintain our cautious view and focus on the fundamentals. For a contrarian investor, there are many deep value opportunities that could be exploited by the right managers.

European market

The global industrial sector has faced a prolonged downturn over the past two years, driven by pandemic-era supply chain challenges that have been tough to overcome. European manufacturing has struggled further, grappling with labour constraints, an energy crisis and the Ukraine War.

Yet, a closer look reveals a brighter prospect for Europe. 2025 is shaping up to be a pivotal year for capital investment, driven by ECB initiatives to stimulate growth and CEOs seizing opportunities to deploy capital effectively.

Whilst US technology companies have dominated the AI narrative; Europe offers compelling growth opportunities in this space. Investing in European firms tied to these key industrial themes can complement portfolios already heavily weighted toward U.S.-based tech stocks and the US dollar. Given that the US dollar could be seen as structurally overvalued, increasing exposure to non-U.S. assets, such as European equities, could offer diversification and potential upside.

Read more about our European long-short equity fund here: Asset Allocation Update April 2023 | Saltus.[10]

A boost from China

European companies also stand to gain from China’s recent stimulus measures. As Europe’s second-largest trading partner (after the US), China’s continued policy support could translate into stronger revenues for European firms, especially those deeply tied to global trade.

Positioning for growth in 2025

The challenges of the past two years have masked the transformative potential within Europe’s industrial sector. By focusing on innovative and high-growth areas such as AI, infrastructure, aerospace and defence, investors can tap into Europe’s unique strengths. As capital investment ramps up in 2025, these opportunities could play a significant role in delivering value and driving growth in well-diversified portfolios.

The Bright outlook for Japanese equities in 2025

Despite short term market fluctuations, we maintain an optimistic outlook for Japanese equities, driven by two transformative trends: enhanced corporate governance and a significant shift in Japan’s economic landscape from deflation to inflation. These developments offer compelling opportunities for investors looking to tap into the country’s evolving market dynamics.

Read more about Japan here: Japan’s Economic Renaissance | Saltus.[11]

Corporate governance: A game changer

Japanese corporations are undergoing a governance revolution, making strides toward more transparent and shareholder-friendly practices. This transformation is creating a more attractive environment for both domestic and international investors. For instance, companies are increasingly focused on improving return on equity (ROE), boosting shareholder returns, and embracing structural reforms.

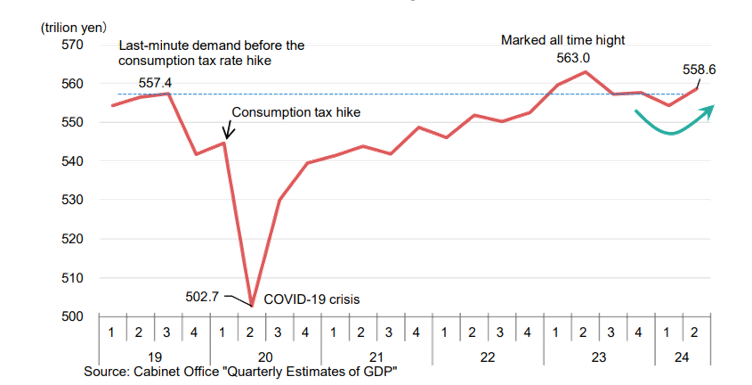

From deflation to inflation: A new economic era

For decades, Japan’s economy grappled with deflation, which stifled growth and profitability. However, recent shifts toward a more inflationary environment are revitalising the economic landscape. Moderate inflation supports higher pricing power for companies, enhances revenue growth, and creates a more robust economic outlook.

Chart Showing Real GDP Growth Rate Japan

Source: MUFG[12]

The Bank of Japan’s surprise rate hike in July 2024 drew significant attention, contributing to market volatility in August. However, we believe this volatility was not solely a result of the rate hike. Instead, it reflects a broader liquidity-driven adjustment, as markets recalibrate to the changing economic environment and look to remove positions in the carry trade.

Why we’re optimistic about Japan

Japan’s evolving landscape, coupled with these structural reforms and macroeconomic shifts, positions its equity markets for long term growth. Corporate governance improvements are attracting fresh capital, whilst the shift to inflation provides a stronger foundation for profitability and economic expansion.

Though short term volatility may persist, these trends point to promising opportunities for investors. The increased interest in Japanese companies, along with the surge in M&A activity, is setting the stage for a dynamic and potentially lucrative year ahead for Japanese equities.

Investors looking to diversify globally may find that Japan’s transformation offers a unique chance to capture value in a market undergoing significant positive change.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

Emerging markets vs. developed markets: Where should investors focus in 2025?

As global central banks ease monetary policies, some investors may consider increasing exposure to emerging markets (EM). Historically, rate-cutting cycles have supported EM assets, driving growth, capital flows, and currency trends that benefit exports. However, we also need to consider some of the associated risks.

You can read more about our thoughts on emerging markets here: Emerging markets outlook | Saltus.[13]

Whilst there are opportunities within emerging markets, they also face significant challenges:

- Despite new government stimulus measures, China’s economy continues to struggle with low consumer confidence and a painful deflation of its property bubble. Retail sales remain 16% below pre-pandemic levels, signalling ongoing weakness. Additionally, the possibility of a renewed trade war with the US adds further uncertainty.[14]

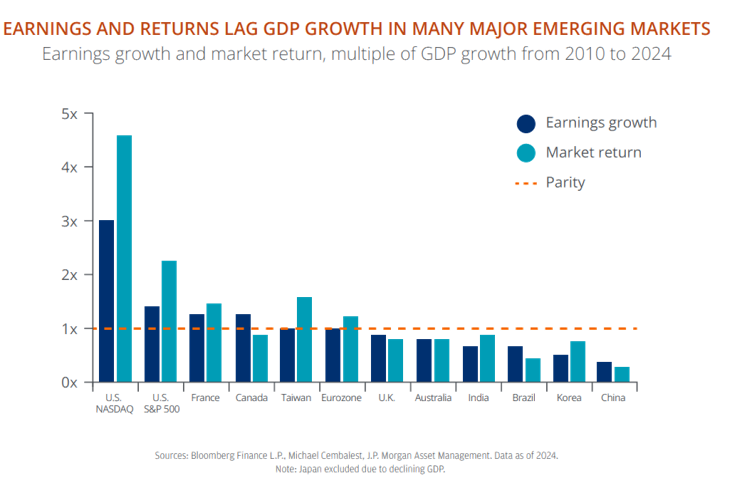

- Even when EM economies achieve robust GDP growth, this doesn’t always translate into earnings per share or market returns. Shareholder dilution, volatile earnings, and fluctuating currency values can disrupt compounding, limiting long term performance.

Source: JP Morgan [3]

Developed markets offer stronger prospects

In contrast, developed market (DM) equities, particularly in the US and Japan, present a more compelling investment case for 2025.

Profit margins in the US remain stable at all-time highs. Companies in the S&P 500 continue to return significant earnings to shareholders, with nearly 75% distributed through dividends and buybacks this decade, up from 50% in the 2000s. In 2025, every sector in the S&P 500 is expected to deliver positive earnings growth, a feat not seen since 2018.[15]

Japan’s Corporate Transformation: Japanese companies have made impressive progress in corporate governance and shareholder-focused practices. Share buyback announcements in 2024 doubled previous records, creating attractive opportunities for investors, especially in private equity.

Together, these trends suggest that developed markets may outperform emerging markets in 2025, continuing the pattern observed in eight of the past ten years.

Bright spots in emerging markets

Despite the challenges, certain EM regions hold promise. So called Frontier Markets such as Greece, Kazakhstan, Egypt, and Saudia Arabia stand out as markets with the potential to deliver strong shareholder returns in both public and private investments.

Read more about our frontier market fund here: Asset Allocation Update August 2023 | Saltus[16].

Conclusion: Balanced global positioning

Whilst developed markets like the US and Japan are poised to lead in 2025, selective opportunities within emerging markets could enhance a well-diversified portfolio. Staying informed and focused on regions with strong fundamentals will be key to navigating the evolving global landscape.

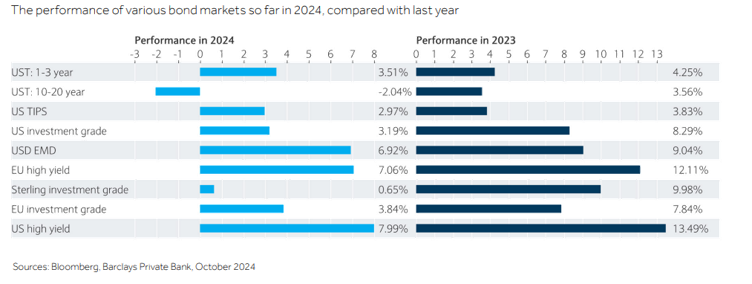

Fundamental shifts in bond markets

The bond markets delivered mixed returns in 2024, contrasting their solid performance in 2023. As shown in the performance chart below, long-dated government debt lagged considerably behind short-dated, but both lagged areas in the corporate debt market, with high-yield debt being the strongest performer.

Overview performance of bond market 2023 to 2024

Source: Barclays PB[17]

A global rate-cutting cycle begins

Central banks have started cutting interest rates, with inflation in most developed economies steadily declining towards the magical 2% target. This change marks a pivotal shift in monetary policy, providing a supportive backdrop for bond markets and boosting investor confidence in longer-term stability.

The yield curve returns to normal

Another critical development in 2024 was the “uninverting” of the yield curve. As short term yields declined with the onset of rate cuts, long term bonds retained their typical higher yields relative to short term counterparts. This normalisation reflects a healthier economic outlook and offers renewed opportunities for investors seeking returns across the bond market spectrum.

Positioning for opportunities

These changes in inflation, interest rates, and the yield curve suggest a more favourable environment for fixed-income investments. This may be an opportune time for investors to consider credit markets and diversified bond strategies but be cognisant of stretched valuations.

Whilst some of the ‘easy pickings’ may already be behind us, savvy investors can still uncover attractive opportunities in 2025. Our process lies in adopting a balanced and cautious approach, minimising risks rather than chasing outsized gains and ensuring portfolios avoid over-concentration in specific bond market segments.

Over the past year, we have been adding to a mix of short-dated US and UK government bonds in our portfolios and diversifying by adding strategic corporate credit managers.

Read more about one of our Bond funds here: Asset Allocation Update April 2024 | Saltus.[18]

A balanced approach to duration

Maintaining a neutral interest rate risk exposure is prudent as we head into 2025. Investors should remain vigilant for signs of rate volatility, which can present opportunities to increase duration and capture additional returns selectively. For much of 2024, we have remained below the Bloomberg Global Aggregate Index duration, and as we have moved into a falling interest rate environment, we have started to increase.

Credit markets: Opportunities in diversification

In the corporate debt space, the more strategic credit managers can serve as an effective tool for portfolio diversification, helping to spread risk across different types of debt. Additionally, the BB-rated segment offers compelling relative value and carry opportunities, providing a sweet spot for investors seeking balanced risk and return.

Convertible bond market

One hedge fund we continue to include in our portfolios operates within the Global Convertible Bond market, combining event-driven strategies with a hedged convertible framework. The strategy offers higher return potential than high-yield bonds with historically less risk than investment-grade debt and minimal sensitivity to market fluctuations. The fund thrives in uncertain markets and is designed with a defensive focus on short-dated, high-quality credit and low leverage. Its innovative structure has delivered strong risk-adjusted returns, benefiting from market volatility and economic uncertainty, making it a valuable addition to diversified portfolios.

To read more about this fund, please click here: Asset Allocation Update February 2024 | Saltus.[19]

Exploring emerging market debt & high yield (EMD)

Emerging market debt continues to present a wealth of possibilities for improving a portfolio’s risk-return profile. With a broad and diverse set of issuers, EMD offers exposure to high-growth regions and the potential for attractive yields.

Positioning for success

Investors navigating the fixed income landscape in 2025 should prioritise diversification, remain adaptable to interest rate changes and explore relative value opportunities across segments. By doing so, they can still uncover meaningful returns in a more challenging bond market environment.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

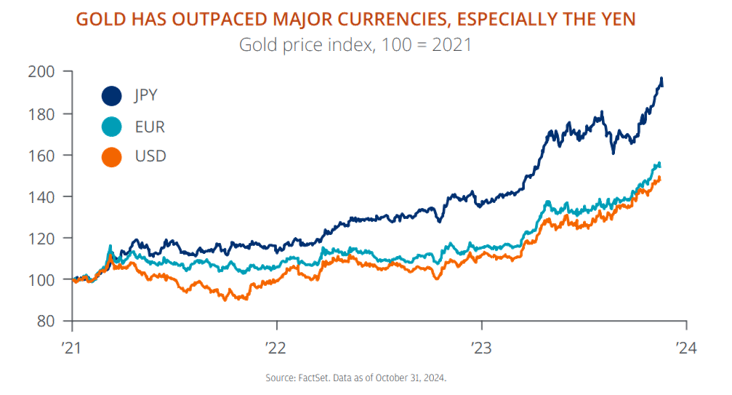

Gold shines bright

Gold reached record highs in 2024, and all signs seemingly point to continued momentum in 2025. Beyond just focussing on potential positive returns, gold can play a critical role in enhancing portfolio resilience for investors.

Strong demand from central banks and retail investors

One of gold’s primary drivers is new demand from non-US central banks, particularly in Emerging Markets. Over the past year, these banks have purchased 1,500 tons more gold annually compared to pre-2022 levels, reflecting a structural shift in reserve management. For example, the People’s Bank of China holds just 5% of its reserves in gold, compared to the European Central Bank at 60% and the Federal Reserve at 73%. This gap suggests further buying could be on the horizon.[20]

A timeless safe haven

Gold has long been considered the ultimate safe-haven asset, and for good reason. It can offer protection against geopolitical risks and concerns about sovereign debt sustainability. Historical data underscores this: in an analysis of around 50 geopolitical events since World War II, gold often acted as a reliable short term hedge against equity market volatility.

Another compelling reason to consider gold is its role in diversifying currency exposure. With the US dollar viewed as structurally overvalued, gold can provide a stable and efficient alternative to reduce reliance on any single currency.

Source: JP Morgan[21]

Positioning for 2025

As we look to the year ahead, gold’s upward trajectory appears supported by strong fundamentals. Whether as a hedge against market volatility, a defence against geopolitical uncertainty, or a tool for currency diversification, gold is well-positioned to remain a valuable asset in any portfolio. We maintain our exposure to gold and gold miners in our portfolios heading into 2025.

Navigating the many risks in today’s market environment

In an increasingly complex financial landscape, investors now face a variety of risks that could converge and rapidly shift market dynamics. As portfolio managers, it’s crucial to stay vigilant and adaptable, as these risks have the potential to emerge simultaneously, necessitating a review of our strategy.

Fiscal risks: The pressure on government balance sheets

Governments worldwide are operating with stretched balance sheets, a by-product of extensive fiscal stimulus in recent years, mainly as a direct consequence of the pandemic. If economic growth falters or inflation fails to ease as expected, there’s a real risk of a disruptive repricing of government debt. This scenario could lead to higher borrowing costs for governments, creating ripple effects across financial markets. Investors should be cautious about overexposure to government bonds and consider diversifying into assets that can better withstand fiscal turbulence. By diversifying our bond exposure to corporate credit, which typically has a shorter duration, and the use of strategic bond managers, we are able to minimise this potential risk.

Political risks: A shifting global order

The transition to a multipolar world where geopolitical power is distributed across multiple nations, brings both opportunities and challenges. Heightened risks of trade conflicts, military tensions, or political instability could disrupt global markets. For instance, escalating trade disputes or regional conflicts could negatively impact supply chains and market sentiment. A diversified portfolio and a focus on geopolitical hotspots can help mitigate these risks. Over the past year, we have sold out of positions with heighted geopolitical risk such as parts of the Middle East and bought into areas with a more stable outlook.

Recession risks: The role of sticky inflation

Whilst many central banks are beginning to cut interest rates, persistent inflation could derail this easing cycle. If inflation proves stickier than expected, central banks may have to pause or reverse rate cuts, potentially pushing economies back into recession. This scenario underscores the importance of balancing risk in portfolios, with an emphasis on income-generating and defensive assets.

Rotation risks in equity markets

Equity markets are currently marked by significant rotation risk; uncertainty about which factors will drive returns. With no clear dominance among growth, value, or other investment styles, maintaining a broadly neutral stance across these key factors is a prudent approach. This ensures investors are not overly reliant on any single market narrative. Over the past 12 months, we have maintained a slight tilt towards smaller capitalised companies with a quality focus. However, throughout the year our allocations have become more neutral.

Read our latest asset allocation update here: Asset allocation update October 2024 | Saltus.[22]

Narrow leadership in equity markets

A small number of themes and sectors, such as technology and AI, have been driving equity market performance. This concentration leaves markets vulnerable to a sharp correction if these trends falter. Diversification across sectors and geographies is critical to reduce dependency on narrow leadership.

The AI boom: Market expectations vs. reality

The current wave of investment in AI is unprecedented, but markets will eventually demand tangible returns from these ventures. If these returns are not immediately apparent, there’s a risk of a selloff in overvalued tech stocks. Investors should look for AI opportunities with proven scalability and realistic revenue models whilst being cautious of speculative names.

Credit market risks: Refinancing pressures ahead

Credit markets are currently enjoying robust demand, but the next few years will bring a wave of refinancing needs. This will require stable financial conditions and high liquidity. If market stability wavers, companies could face difficulty refinancing debt, increasing default risks. High-yield and leveraged credit exposures should be carefully managed, with a focus on high-quality issuers.

Leveraged strategies and systemic risks

Rules-based and leveraged investment strategies have become dominant across asset classes, amplifying the risk of market disruptions. In periods of heightened volatility, these strategies could exacerbate market movements, turning a modest correction into a more severe downturn. Building resilient portfolios with lower leverage exposure can help weather such scenarios.

A proactive approach to risk management

Whilst the risks are varied, the key to navigating them lies in vigilance, diversification, and a balanced approach to asset allocation. By staying attuned to evolving market conditions and proactively adjusting portfolios, investors can better position themselves to seize opportunities, whilst managing potential downside risks.

Summary

As we look ahead to 2025, the year is shaping up to bring a mix of innovation and uncertainty, creating both challenges and opportunities in financial markets. By focusing on portfolio flexibility, steady income, and diversification, investors can better navigate unexpected shifts and take advantage of emerging opportunities. A thoughtful, balanced approach that combines resilience with diversification will be essential for continued success.

Connect with a Saltus Investment Manager to explore how these trends may influence your investment strategy and financial plan.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.