When it comes to preparing for retirement, your 40s can arguably be the most crucial decade for building the retirement you are seeking. In these years, you are likely to be in the busiest time with work and closest to your peak career earnings, possibly building a family, and you may have significant liabilities such as a mortgage. With all of this in mind, it is easy to let your financial planning slip to the bottom of the pile.

Example scenario

Let’s think about an example family – Mark and Debbie are both aged 45 and have two children, Laura (aged 8) and Michael (aged 6). Mark works as a sales consultant earning a total remuneration of £85,000 per annum including bonus/commission whilst Linda is working part time as an administrative assistant earning £10,000 per annum. We will use this family throughout the below planning areas to show how their circumstances can be affected.

Protection – family income benefit and emergency fund

At this stage of life, it is likely that most people will have taken on significant liabilities such as mortgages, car finance or have some outstanding credit card debt. Although a difficult consideration, one of the key risks of this age is unemployment or early death and being unable to repay those outstanding debt repayments.

This is particularly true for Mark, considering he is the primary income source of the family, who are reliant on his earnings, not only to repay things like their mortgage but basic monthly expenditure such as food, travel and school costs. It is therefore clear the importance of building a contingency plan for if Mark were to lose his job, become terminally ill or pass away to cover these costs. One option to consider would be a family income benefit plan if Mark were to pass away or become critically ill. An indicative quote for Mark and Debbie to cover £3,000 per month tax-free income until their youngest son, Michael, reaches age 18 would cost £111.08 per month, subject to medical underwriting – a relatively small cost considering the peace of mind received from having such protection.

| Provider | Life cover per annum | Critical illness cover per annum | Indexation type* | Total monthly premium |

|---|---|---|---|---|

| Zurich | £36,000 | £36,000 | Increasing by RPI | £110.08** |

Source: [1]

*Indexation provides an increase in cover over time by increasing it with Retail Price Index (A measure of inflation) to ensure the real value of cover remains constant.

**Premiums are guaranteed meaning they will remain fixed for the life of the policy.

It is always worth understanding what employer provisions are available as part of your employment contract. As a minimum, most employers will provide some sort of life cover in the form of a death in service plan, however many employers seek to offer a competitive package and may offer further provisions such as private medical insurance, critical illness and more.

Aside from this, building an emergency fund of 3-6 months’ worth of family expenses is the first step in protecting you and your family for when things don’t go according to plan, for example, unexpected costs or temporary loss of income.

Do you need help with your retirement planning?

Our specialists can help you prepare for retirement and provide ongoing advice once retirement has arrived. Get in touch to discuss how we can help you.

Pension contribution and consolidation – recovering lost child benefit

During the Spring Budget 2024, it was announced that the High Income Child Benefit tax charge threshold would be increasing to £60,000 (from £50,000)[2]. Where income exceeds £60,000, the child benefit is lost at a rate of 1% for every £200 adjusted net income above this level, up to £80,000 where it is lost completely. For example, someone earning £65,000 would lose 25% of their child benefit received in the form of a tax charge. It is worth knowing that this tax charge always falls on the highest earner in the household, regardless of who is claiming.

In our example scenario above, Mark would lose 100% of the child benefit due to earning in excess of £80,000. One way to regain some, or even all, of this child benefit could be through making pension contributions to bring Mark’s adjusted net income down to below the threshold for losing his child benefit, thus regaining the full entitlement to child benefit at £25.60 per week for first/eldest child and £16.95 for additional children.

Further to making tax-efficient contributions for the sake of child benefit, it is important at this age to consider what retirement looks like for you. Are you looking to retire early? Take lavish holidays? Pay off your mortgage at a certain age? All of these questions can help in planning towards building the retirement you are looking for and ensuring we aren’t playing catch up later in your working career.

On average, people have over 7 jobs in their lifetime[3]. Doing so can create a multitude of pensions accumulated with multiple providers and conflicting investment approaches towards retirement. Consolidating these into a single investment strategy optimised for your circumstances, plans and what you want from retirement can also help in building the retirement you are seeking.

Investing outside of pensions

Whilst we often associate pensions as being our income source in retirement, it is important to build an income plan derived from various tax wrappers, where possible, to manage tax allowances. Whilst pensions come with significant tax benefits whilst accumulating, as well as 25% available to be taken as tax-free cash[4], the remainder is taxable under income tax rules, which has the potential to be taxed up to 45% for additional rate taxpayers.

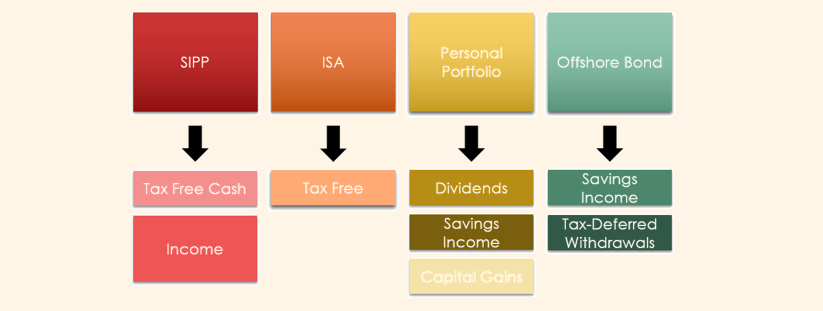

Additionally, pensions cannot be accessed until age 55, rising to 57 in 2028, so dedicating all of your retirement contributions to pensions in your 40s can create difficulties if you needed to draw on funds for unexpected reasons. We therefore need to think about other tax wrappers and tying in the use of their allowances in order to build a tax efficient income strategy for the future, whilst we are in our higher earning years. Options for this include ISAs, unwrapped personal portfolios/General Investment Accounts and investment bonds, which all come with differing tax treatments.

Source: Saltus Financial Planning, May 2024 [5]

Making use of these allowances and tax treatments can either help to increase the amount of income in retirement or extend the longevity of the income in retirement without impacting lifestyle.

Estate planning & wills

One of the foundations of a financial plan revolves around ensuring your assets are passed to the individual or individuals you want them to, and one of the key ways to ensure this happens is by making sure that you have a valid and up to date will. It is one of the most frequent things I see as an adviser that clients have updating their will on their ‘to-do’ list, but it very rarely reaches the top of the list. Updating your will – particularly when circumstances change, for example, having children, getting married or divorced, or death within the family – is such an important exercise which is often overlooked. Given that during your 40s the likelihood of the above scenarios occurring is high, it is important to check that your will provisions match your intended estate distribution, and all beneficiaries are listed.

Dying without a valid will leaves your estate to be distributed in accordance with the laws of intestacy which, if unmarried, means that blood relatives receive your estate on death before long-term partners, which is not always the intention.

Conclusion

Your 40s are a critical time period where life events cause a significant need for financial planning to plan for both now and in the future. Circumstance changes create a need to review and update financial plans and taking some of the complexities out of this can allow you to focus on what is important to you, such as spending time with your family or focussing on your work, leaving an adviser to do the manual ‘lifting’ towards your retirement.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.