What’s been the focus at Saltus?

As we enter a period of broadening global growth and easing inflation, equities (i.e. stocks), have continued to thrive in this bull market. We remain enthusiastic about quality stocks, recognising the opportunities extending beyond just the ‘Magnificent 7’ in the US, which is our favoured market. We have continually over the year added to the S&P 500 to capture gains in the world’s largest equity market. In real terms we have been allocating capital to more cyclical equity segments, such as mid-cap and industrial equities in the region. The second half of the year potentially promises a favourable market environment with the onset of a new growth and interest rate cutting cycle. Market corrections should be viewed not as prolonged declines, but as potential opportune moments for investment.

Why do we like the US?

The US stock market remains our largest allocation due to its strong growth and good investment conditions over multiple consistent time periods. While the largest seven companies: Alphabet, Amazon, Apple, Meta, Microsoft, Tesla, and NVIDIA have been leading the index, their earnings are expected to grow more slowly. In contrast, other parts of the market, like mid-sized companies, are expected to see stronger growth in the years to come. US stocks beyond the top seven should benefit from the ongoing economic expansion, investments in artificial intelligence (AI) across various industries, reindustrialisation, and the push towards a greener economy, all aligning with the current US policy outlook.

Mid-caps US

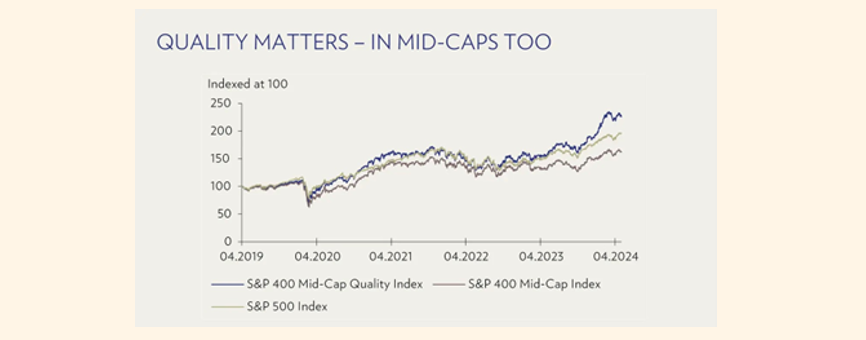

The current stock market rally has been led by large/mega-cap stocks, but since the beginning of the year, it has become much more balanced. With the US economy showing strength and positive signs from Europe and China, mid-cap stocks, which tend to be more sensitive to economic cycles, are now joining the rally and have potential to catch up. At Saltus, we prefer high-quality mid-cap stocks, many of which can be represented by the S&P 500 with an equal weighting to the index. Throughout 2024 we have added to this market through our various US and global funds, allowing us to capture much of the upside. The S&P 500 is up around 15% on the year as of the end of June 2024. The chart below simply shows the outperformance of mid-cap quality companies when compared to the S&P 500. [1]

Source: Bloomberg, S&P 400 Index [2]

A note on Japan

Structural reforms are significantly boosting Japanese stocks, which are also gaining from substantial investments aimed at turning Japan into a major semiconductor hub. With the Yen at its lowest in decades, Japan is attracting tourists and presents a great opportunity for investors to tap into a promising market with strong earnings growth. Therefore, it’s still a good time to invest in Japanese stocks, even after their recent gains. The same positive outlook applies to global stock markets as well. We have remained bullish on Japan having had a significant overweight position from the tail end of 2023 and into 2024 [3]. We have highlighted a few Japanese fund allocations in previous asset allocation updates, which can be read here: Asset allocation update | Saltus

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

Thoughts on the US election?

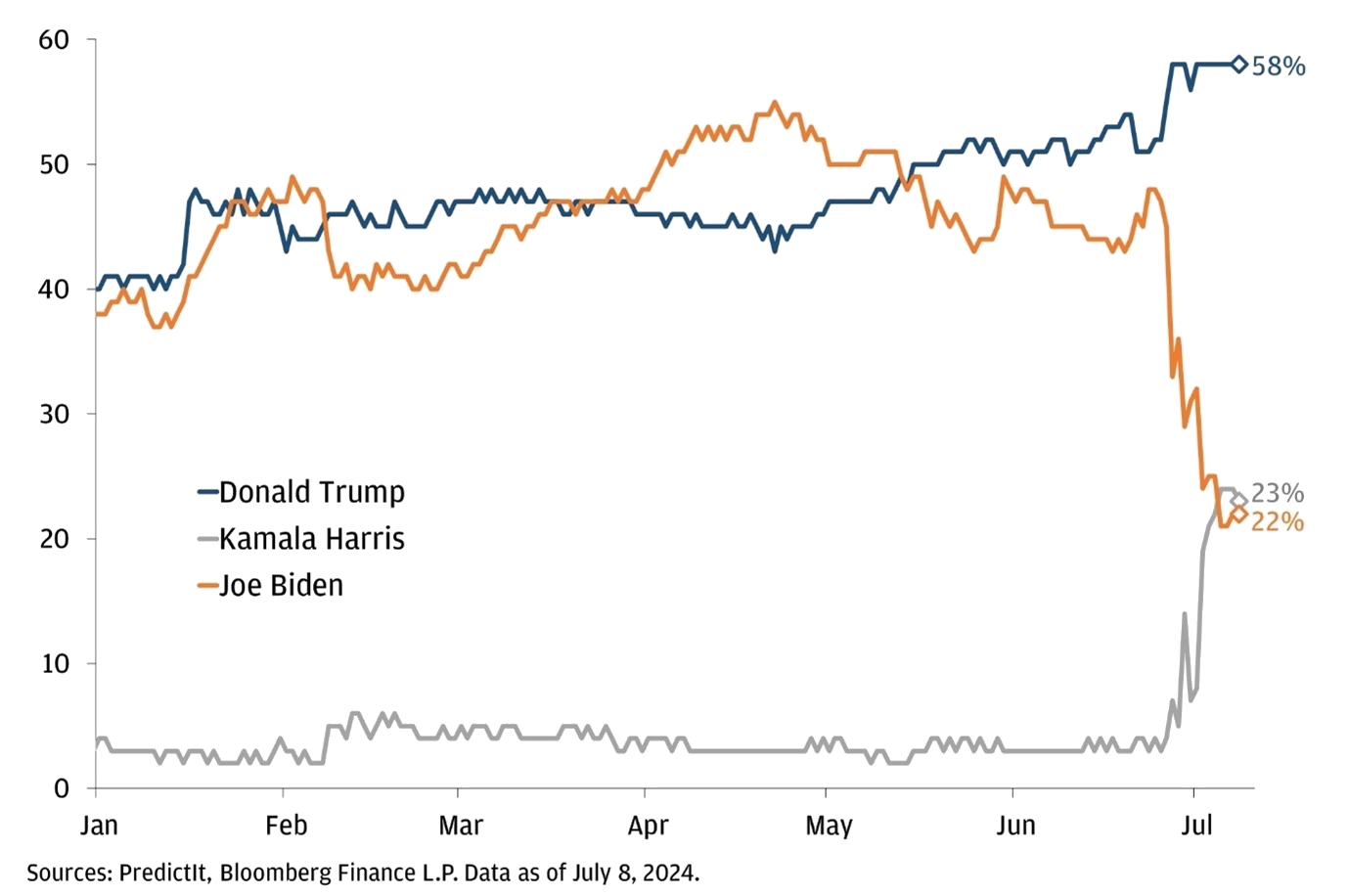

Four months before the US election and the race seems to have shifted significantly. After what was widely seen as a disappointing performance during the June 27th Presidential debate, President Biden aimed to improve his current standing with an ABC news interview last week. Despite a seemingly stronger showing there, doubts about his future persist, with many senior Democrats calling for him to resign from his campaign.

Although White House officials have not suggested that Biden will drop out, betting markets are now favouring Kamala Harris over Biden for the election. These betting markets are more retail-oriented and do not reflect larger institutional capital but are still interesting as an indicator of public sentiment.

Source: Predictit [4]

What about the UK? Things are looking Starmer…

Keir Starmer and the Labour Party have very recently taken up their new home at 10 Downing Street as many had predicted months ago. Although a change of power may have initially seemed volatile for markets, investors have not reacted much to the election result due to both major parties having similar centrist policies, and the polls consistently showing a clear outcome. In fact, the most recent updates have shown investors to welcome the new Labour government and the policy updates to be made in the first 100 days [5].

So, what’s next? The new Labour government is inheriting a UK economy that has underperformed for over a decade, and their spending options are limited by growing debt problem. However, Labour’s ‘pro-growth, pro-business’ manifesto aims to boost the UK economy in the next term. The real outcome and plan for this is yet to be seen. Since the party has ruled out changes to major tax rates (income tax, National Insurance, VAT, corporation tax), their ability to spur growth through public spending is restricted. After the fallout from the 2022 minibudget, Labour is cautious about making ‘unfunded’ spending plans.

Given the fragile state of public finances, Prime Minister Keir Starmer and Chancellor Rachel Reeves emphasised fiscal responsibility before the elections. Their manifesto suggested a modest £9 billion increase in spending, mainly funded by closing ‘tax loopholes,’ which is relatively small compared to the UK’s £3 trillion economy. While detailed plans for taxation and spending will likely come in the Autumn budget announcement, it’s expected that Labour will pursue fiscal consolidation (about 0.5% of GDP next year), which could slightly slow the UK economy in the near term.

In terms of changes to expect, here’s a rundown of the policy changes that stood out to us in the Labour manifesto [6]:

- Planning reforms – A key part of Labour’s growth plans. With limited room for public spending, the party seeks to attract private capital through planning reforms to revitalise the economy. For example, removing planning barriers for new data centres aims to accelerate growth in the UK’s artificial intelligence sector, and regulatory changes will encourage innovation.

- Changes to the non-dom regime – After the Conservatives ended the UK resident, non-domiciled regime at the Spring budget, Labour has hinted at further tweaks. For instance, any non-doms with offshore trusts may now see those assets subject to inheritance tax. Other tweaks, such as removing the transitional relief for foreign income, have also been discussed.

- Tax on carried interest – Labour plans to adjust the laws around taxation on carried interest for private equity principals. This would affect about 3,000 people in the UK and is expected to raise nearly £550 million per year for the government.

- Green prosperity plan – Labour aims to boost green investment, intending to increase spending on renewable energy by 60%, which would cost nearly £5 billion per year.

- International trade – Brexit remains a contentious issue. Labour has ruled out rejoining the EU single market but is committed to improving trade relationships to strengthen the UK’s supply chain.

- Energy profits levy – Plans to raise around £6 billion by increasing and extending “windfall” taxes on oil and gas companies.

Labour’s policies aim to balance fiscal responsibility with economic growth. This is challenging given the current state of public finances. The large Labour majority could risk a shift to the ‘left’ over time, but this seems unlikely due to Labour’s share of the total votes not being as strong as their number of seats. They will need to follow fiscal rules to avoid losing their majority in the next term.

More details will come in the next budget (likely in October or November this year) but, for now, Labour’s majority brings much-needed stability to UK politics during a time of global uncertainty. This stability makes the UK seem like a safe haven in the political turbulence of 2024.

As a result, we are more confident that the UK could become a more attractive place for individuals, businesses and investments in the coming years and therefore a potential focus area for our portfolios.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

When will interest rates start to be cut?

The UK economy is in good shape as we enter the second half of the year. Although growth isn’t very strong, the technical recession of 2023 is truly behind us. Most people who want jobs have them, wages are rising, and inflation is decreasing, which are all positive indicators for growth and the beginning of a new cycle.

We do not believe the change in political power in the UK will significantly affect the economy in the short term. More stability could help support the pound, which we expect to be bolstered by high carry and improving global growth over the next year. However, inflation and interest rates will likely remain the primary drivers for markets in the coming months.

With inflation moving closer to the 2% target (although services prices remain relatively high), the Bank of England hinted at lowering policy rates in their August meeting. Markets are now pricing in an August/September initial rate cut, starting with a quarterly reduction pace and bringing rates below 4%. The risk seems tilted towards a faster cutting cycle, especially with the potential for tighter fiscal policy.

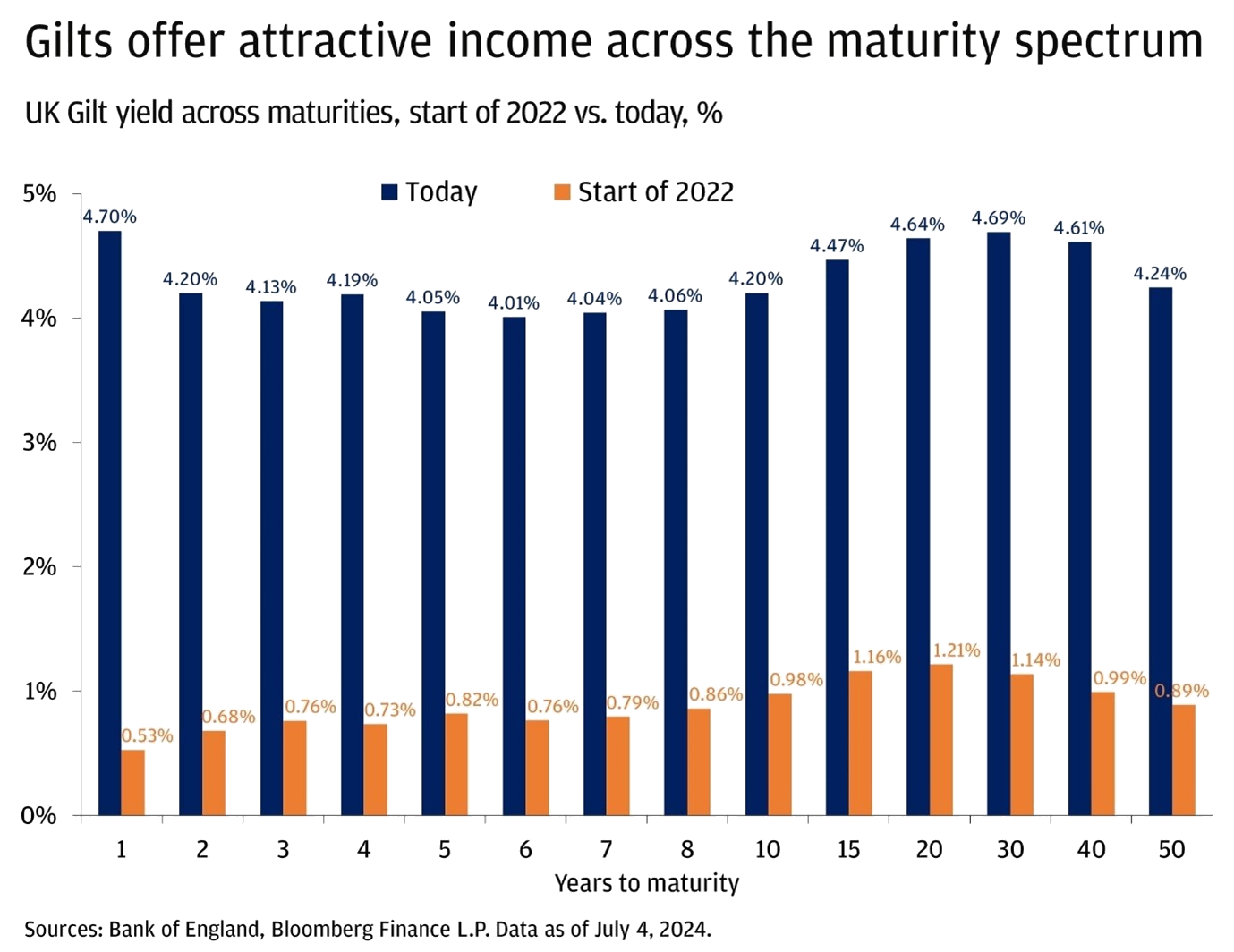

Therefore, today’s high cash rates above 5% probably won’t last long. Markets have, however, seemed to underestimate the likelihood of Bank of England cuts starting in July, creating an opportunity to lock in longer-term yields in UK fixed income markets, particularly at the front end, which is more sensitive to central bank policy rates.

Additionally, UK resident taxpayers benefit from an exemption on capital gains tax when purchasing UK government bonds (or gilts), meaning only the ‘coupon’ or the interest received is taxed.

When bonds are issued, they pay a coupon reflecting the interest rates at that time. In recent years, many bonds were issued with very low coupons. As interest rates have risen, investors have preferred bonds with higher income payments, lowering the price of low-coupon bonds. This means more of the yield on UK gilts today comes from capital gains at maturity rather than coupon payments. Below is a graph showing the yields of gilts in 2022 compared to now. We have been increasing duration in our gilt position this year having avoided much of the value depreciation of the UK bond market in 2022.

Source: Bloomberg, JP Morgan [7]

Final thoughts…

Volatility around political events is usually short-lived, and we expect this year’s elections to follow that trend. However, today’s governments face tough challenges, leading to potential winners and losers based on political leadership worldwide. Rising debt means new expenses, like defence and security in a tense geopolitical climate, will require higher taxes or cuts in other spending areas when looking across the pond.

As we head into the summer, we expect the current trend of volatile returns to continue but lessen in intensity. With more inflation data, another corporate earnings season, and increased focus on the US elections, there will be plenty for investors to consider. The performance patterns we saw at the start of the year are still in play. Larger, high-quality growth companies are doing better than smaller, value-style investments. US assets are generally outperforming those outside the US. The dollar remains strong, and market leadership is narrow, dominated by the ‘Magnificent 7’ tech companies in the US and a similar group of six large companies in Europe [8].

These trends have persisted for months without showing signs of reversing. However, as valuation gaps widen and future expectations rise, the risk-reward balance is becoming more uneven. In response, we’ve been gradually shifting investments away from these overextended market themes and toward assets that have been less favoured. This strategy is partly for risk management but also because we see more long-term upside in assets with low expectations. It’s a subtle process with no major month-to-month changes, but we believe it will be beneficial as we move into the second half of the year and beyond.

Investment portfolios should be prepared for various outcomes. We believe a globally diversified portfolio provides stability, but other non-traditional investments can also offer protection against unexpected events. Real assets like infrastructure, gold and commodities often perform well during inflationary policies, while core bonds do better when growth slows and central banks cut interest rates.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.