For some, £1 million might sound like a fortune, whilst for others, it may not seem nearly enough for a comfortable retirement. Your ideal retirement pot depends on your lifestyle, spending habits, healthcare needs, and how well you manage your assets. Understanding whether a £1 million pension pot is enough to retire requires careful planning. Consulting a financial adviser can help tailor a retirement plan to your specific needs.

How much do you need to retire?

According to the Pensions and Lifetime Savings Association (PLSA) and the University of Loughborough, for a ‘comfortable’ retirement:

- A single individual will incur expenditure of £43,900 gross per annum

- A couple will incur expenditure of £60,000 gross a year.[1]

According to the PLSA, this would afford you a lifestyle that allows for some spontaneity, including having a subscription to a streaming service or a yearly holiday outside the UK.[2]

However, many aspire to more in retirement. We surveyed over a thousand individuals who had more than £250,000 in investments in our annual Saltus Wealth Index. The results were telling: 60% of respondents believed they would need more than £50,000 a year in retirement (regardless of their marital status), whilst more than 20% anticipated needing over £70,000.[3]

Ultimately, retirement looks different for everyone. To get a clear, personalised understanding of how much you’ll need, speaking with a financial adviser can be invaluable.

The 4% rule: A useful guideline, but not a guarantee

Back in the 1990s, financial planner William Bengen developed the 4% rule as a rough guide for sustainable withdrawals in retirement.[4]The idea is that if you withdraw 4% of your savings annually, adjusted for inflation, your money should last at least 30 years. So, if you have £1 million, that translates to roughly £40,000 per year of withdrawals.

As always, real life is not as simple as this. Market fluctuations, healthcare expenses, and changes in lifestyle can all impact how long your money lasts. That’s why it is important to work with a financial adviser and continuously re-evaluate your retirement strategies.

Strategies to maximise your £1 million pension pot

Depending on your retirement goals, a £1 million pension pot may be enough to sustain a comfortable lifestyle for an individual, but only with careful planning. Maximising your retirement savings can provide long term financial security against inflation, market fluctuations, and unexpected expenses. Here are some key strategies to consider:

- Pension drawdown

Rather than withdrawing a lump sum, pension drawdown allows you to take flexible withdrawals whilst keeping the remainder invested.[5] This can help grow your savings over time and ensure a steady income. Regularly reviewing your withdrawal rate is essential to avoid depleting your pot too quickly.

- Annuities for guaranteed income

An annuity converts your pension into a guaranteed income for life or a fixed period. Whilst annuities offer stability, they generally provide lower returns than a drawdown strategy. A mix of annuities and investments can balance security and growth.

- Diversified investments

Keeping your pension pot invested in a well-diversified portfolio (for example stocks, bonds, and property) can provide long term growth. A good financial adviser can help you balance risk and return based on your retirement goals.

- Tax-efficient withdrawals

Strategically withdrawing income from your pension whilst considering tax implications can extend your savings. Making full use of tax-free allowances and spreading withdrawals across multiple years can minimise tax burdens.

- Delaying state pension for higher payments

If you can afford it, delaying your state pension can increase your payments. For each year you defer beyond the state pension age, your weekly payment rises, providing a higher guaranteed income later in life.[6]

How could you retire with £1 million

Let’s put theory into practice. We’ve looked at retiring with £1 million at three different retirement ages: 55, 60, and 66. Our examples are based on an individual and assume:

- You receive the full state pension, increasing by 2.5% annually. In today’s terms, this equates to £11,973 per year. [7]

- The state pension begins at age 67 for those retiring at 55 or 60, whilst those retiring at 66 receive it immediately.

- Your spending increases by 2% a year to account for inflation.

- Investment returns are projected at 4.75% per annum net of charges.

Another key factor is your withdrawal strategy. A huge number of people access their full tax-free cash (TFC) entitlement at the start of retirement, often to pay off their mortgage. Whilst this approach can be useful for some people in retirement, it can also have a big impact on how long your pension lasts. This could present a real opportunity to improve overall wealth if the balance of accessing TFC as an initial lump sum versus using it to supplement income over time is struck correctly.

To illustrate this, I’ve considered two withdrawal strategies for all scenarios:

- A combination of TFC and income (where ‘income’ refers to pension withdrawals), where the TFC is accessed gradually over time.

- Income only (pension withdrawals), assuming the TFC is used for a one-off expense at the start of retirement such as paying off a mortgage.

With a 1 in 10 chance for a 55 year old man to live to 97 and a woman to live to 99, it becomes essential to plan for your pension to ensure it lasts throughout your lifetime.[8] For the below scenarios, the ultimate goal is to maintain a sustainable retirement income for as long as possible.

It is important to note that the below is a simplified version of cash flow planning. Everyone’s situation will be different, so it is important to seek financial advice.

Do you need cover to protect against illness or death?

Our advisers can give you the peace of mind that you and your family are protected against the financial consequences of the unexpected. Get in touch to discuss how we can help you.

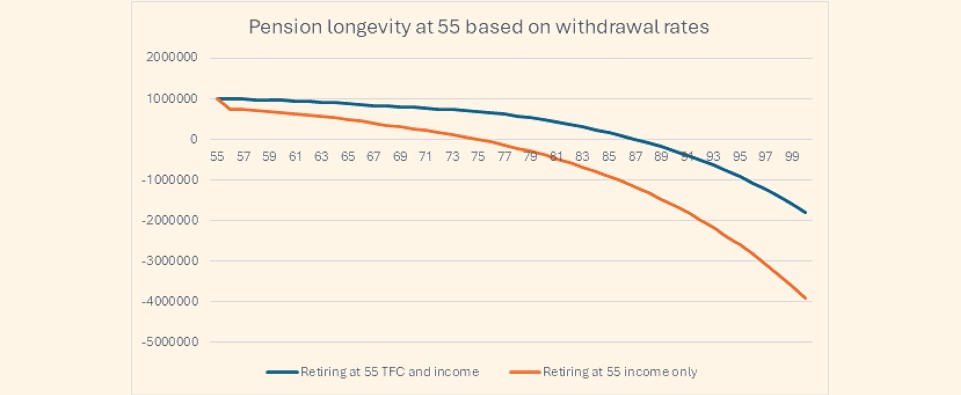

Scenario 1: Retiring at age 55 with £1 million pension fund

If you retire at 55 with £1 million, your initial annual spending is set at £43,900, increasing by 2% each year to account for inflation. Depending on your withdrawal approach, annual income withdrawals will vary:

- Combination of TFC and income: £48,517 per year, including £12,000 of tax-free cash.

- Income only: £51,773 per year from a fund of £750,000, after a £250,000 tax-free cash withdrawal

Withdrawal method and pension longevity

With the state pension commencing at 67, the longevity of your pension fund depends on the withdrawal method:

- TFC and income approach: The fund lasts approximately 33 years, depleting at age 88.

- Income only approach: The fund lasts around 19 years, depleting at age 74.

At first, the withdrawal rate rises gradually. However, as the fund diminishes and the gap between expenditure and the increasing state pension widens, the percentage withdrawn each year accelerates.

Under the combined TFC and income strategy, withdrawals begin at approximately 5% and steadily rise to 10% within just over 20 years, leading to more rapid depletion of the fund thereafter. Conversely, with the income-only method, withdrawals start at around 7% due to the smaller fund size and can exceed 14% within a decade, making this approach potentially risker.

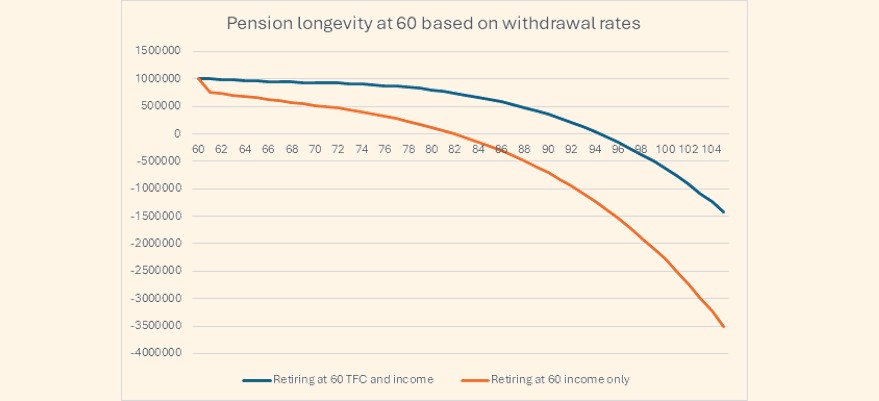

Scenario 2: Retiring at 60 with £1 million

Retiring at 60 can offer a more sustainable outlook. Initial annual spending remains at £43,900, adjusted for inflation. Withdrawal strategies include:

- Combination of TFC and income: £48,517 per year, including £12,000 in tax-free cash.

- Income only: £51,733 per year from a £750,000 pension pot after a £250,000 tax-free cash withdrawal.

Withdrawal method and pension longevity

It is projected that the pension fund will be depleted in each of the following scenarios:

- TFC and income approach: The fund approximately lasts 34 years, sustaining retirement until age 95.

- Income-only approach: The fund lasts around 21 years, depleting by age 81.

With the TFC and income method, withdrawals start at around 5% and gradually double to 10% in over 10 years. For the income-only strategy, withdrawals start at close to 7% and exceed 14% in just under 15 years, highlighting potential sustainability concerns.

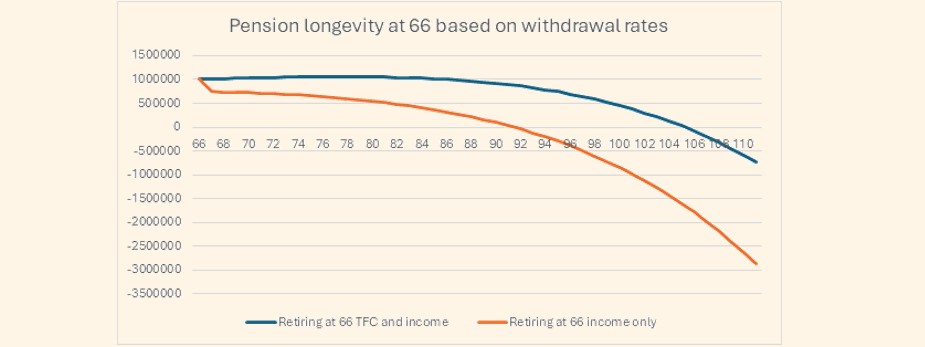

Scenario 3: Retiring at 66 with £1 million

For those retiring at 66, the immediate availability of the state pension provides a significant advantage. Initial annual spending remains at £43,900, increasing with inflation, but the annual state pension of £11,973 reduces reliance on the pension fund.

Withdrawal strategies include:

- Combination of TFC and income: £36,859 per year, including £9,215 in tax-free cash.

- Income only: £39,163 per year from a £750,000 pension fund after a £250,000 tax-free cash withdrawal.

Withdrawal method and pension longevity

It is projected that the pension fund will be depleted in each of the following scenarios as follows:

- TFC and income approach: The fund lasts approximately 40 years, supporting retirement until age 106.

- Income only approach: The fund lasts around 25 years, reaching depletion by age 91.

With the TFC and income approach, withdrawals start at just over 5% and remain below 10% for close to 15 years. Under the income-only strategy, withdrawals start at close to 5% and exceed 10% by around 14 years, still offering better longevity than the earlier retirement scenarios.

Is £1 million enough for you?

Whilst not out of the question, the sustainability of your pension pot depends on a variety of factors including your retirement age, spending habits, investment strategy, and unexpected expenses. Each of these influences how long your money will last.

To establish how your savings stack up, consider speaking to a financial adviser and getting a personalised cash flow plan. Whilst no plan can predict the future with complete accuracy, it serves as a valuable tool for decision-making and understanding potential outcomes. Cash flow plans can also be regularly updated both as you approach retirement and throughout to reflect any changes in circumstances.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.