Interest rates have risen quickly across the world. This created turmoil in many investment markets, but also attractive opportunities for cash savings. So, how should investors be weighing up their options going forward?

In this article we attempt to weigh up the options to help you make better decisions. Do note, however, that the options discussed may not apply to your personal situation, so we encourage you to seek advice from a qualified adviser if you are unsure.

What has changed?

The Bank of England (and their peers in other countries) have been increasing the base rate of interest. It has moved from 0.1% in March 2020 to 5.25% at the time of writing. [1]

Why?

The base rate is the benchmark by which banks and lenders set the interest rates they charge people and companies to borrow money. Assuming no change in income, a higher interest rate on loans (e.g. mortgages) means more money is spent servicing debts, so less money is available to spend on goods and services. The price of those goods and services should therefore rise more slowly than if interest rates are not increased. Central banks have done this to reduce inflation, which is running high in most areas.

What has been the effect of this?

In the investment world, interest rates are important. With borrowing being more expensive, capital is harder to come by so there is less money available to be invested by people and companies, reducing buying pressure across the board, including the demand for buying shares and bonds.

For bonds (e.g. lending money to governments and companies) there is normally a direct and inverse relationship between interest rates and bond values. Meaning that, when interest rates rise, bonds will normally fall in value. The higher interest rates have risen, the harder the bond market has been hit, which is why many bonds suffered double digit losses last year. In fact, UK government bonds (“gilts”) were down about 30% at one point in 2022. [2] Ouch. Thankfully, where investment mandates gave us flexibility to be active, Saltus didn’t own any traditional UK gilts at this time.

On the upside, savers can now get significantly higher returns on their cash levels. You can now get over 4% (variable) on instant access accounts, and some are offering fixed deposit rates at over 6%.

So, what should you do about this?

As always, the answer is… it depends. Firstly, are you thinking short-term or long-term?

Let’s begin by addressing the need for liquidity. Ultimately, you need to make your money work for you and, naturally, you will have times where you will need to call upon your savings. Maintaining a level of cash above your usual monthly spend is of paramount importance. This is money earmarked for near term spending like holidays, school fees, replacing cars and boilers, tax bills etc. Money needed in the near term wouldn’t be recommended for investment due to risk of sudden fluctuations. Although the value could increase dramatically, it could also fall, resulting in the individual selling their investments at a loss.

Everyone has different levels of income, expenditure, and attitudes to risk. Because of this, there is no set rule for how much cash to keep to hand. When advising clients, we normally suggest holding at least three to six months’ expenditure in reserve, as well as keeping money set aside for likely future expenses such as paying tax bills. However, many clients choose to hold much more than this because that gives them peace of mind. Having a discussion with a financial planner could be great way to assess your liquidity requirements.

A financial planner can help categorise your financial needs into short-, medium- and longer-term goals such as buying your first home or planning for retirement. Depending on your life stage and situation, a plan can be put into place to achieve these goals while having minimal impact to your lifestyle.

Thankfully, because cash rates are now a lot higher than they were, holding money in cash could result in something meaningful in the form of bank interest. The downside is that this may not be high enough to protect that capital from inflation, which is currently about 8% in the UK. [3]

For longer-term monies there are lots of options, some of which will give your capital the opportunity to match, or even beat inflation, but this isn’t guaranteed.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

What should you do when assessing cash options?

Bank deposits are typically insured up to £85,000 per individual, per bank, as part of the Financial Services Compensation Scheme (“FSCS”). [4] If you are in the fortunate position of having cash savings in excess of this, then you should consider opening multiple bank accounts to maximise your coverage under the scheme.

Many of our clients use fixed deposits, or term deposits (where the cash is locked up for a pre-determined period of time), for things like tax bills or payments on account to HMRC. This is money they know they will have to pay on certain dates. Because the bank knows you won’t be accessing your money for specified periods, they normally offer these clients higher interest rates.

In practice, this can be a bit of an administrative headache. If you’ve ever tried to open a bank account for a trust or company, then you know the admin headache can be even worse for these. So, companies exist that do the admin for you; you fill in one account opening form, deposit funds on their platform, and they open multiple bank accounts on your behalf to maximise your interest rate as well as your coverage under FSCS. Flagstone is one example, Insignis is another, we’d encourage you to look around to assess your options here.

You can also save using National Savings & Investments (“NS&I”). This is the company who administer premium bonds, but they also offer savings accounts. Because it’s backed by HM Treasury, there is no £85,000 FSCS limit to worry about, all of the money you place with them is guaranteed by the Treasury. Each of their products has a different limit, but some are over £1 million. However, the interest rates are often lower than normal bank accounts. [5]

Note that the interest rate you are quoted on savings accounts is normally before income tax, so do bear that in mind when assessing your options.

In short, shop around for the best rates, maximise your coverage under the Financial Services Compensation Scheme (“FSCS”), and don’t lock away money you might need.

What are some of the other options?

Once you’ve set aside cash for short-term needs, the focus should be on the longer-term.

The key to investing is understanding your financial goals over different time periods and addressing these needs by putting your money to work. Cash has traditionally been seen as a safe haven asset but, with the current level of inflation in the UK, the real levels of degradation to wealth can be felt even if inflation is harder to feel and understand.

Did you know a litre of orange juice costs twice as much today compared to 10 years ago?

Let’s apply this to your finances. If you have £1m in a current account paying 0.25%, with inflation at 8%, you are losing about £6,500 per month of spending power. That’s £77,500 per year.

Even if you shop around and get 4% on the £1m then you would lose over £3,000 per month in spending power. About £40,000 per year.

So, what can you do to beat the return on cash and inflation?

Firstly, we always encourage investors to seek financial planning advice to ensure their capital is in the right place. This can result in significant tax gains, sometimes far higher than the returns on cash, even before you factor in investment returns. Pension contributions, for example, allow investors to reclaim tax at their marginal rate of income tax, locking in a risk-free return of whatever their income tax rate is, which is normally 20-45%, but for those earning just above £100,000 can be as high as 60% (read this article to find out more).

Some of our clients have more capital than they expect to spend in their lifetimes. Advice to them often involves gifting strategies to their loved ones and charities, and/or using structures like trusts. Given inheritance tax is currently at 40%, this can result in substantial tax savings for their beneficiaries.

Once the structuring is sorted, most of our clients invest to beat the return on cash and inflation over reasonable time frames, e.g. those longer than five years. This is because investment portfolios generally outperform cash (although this is not guaranteed).

There have been countless studies looking at long term returns on investment assets such as stocks. Generally, these show that stock markets have generated between 7% and 13% per annum in nominal terms (ignoring inflation) over long periods. The investment management company Vanguard (with $7.2 trillion of assets under management) studied the real (inflation adjusted) return of cash, bonds, and stocks from the end of 1900 to the end of 2022 and they produced the following figures:

| Real (inflation-adjusted) | ||

|---|---|---|

| Asset class | Average annual return above inflation | Greatest annual loss |

| Cash | 0.87% | -10.3% |

| UK bonds | 1.44% | -19.8% |

| UK shares | 5.35% | -21.4% |

Source: Vanguard [6]

These figures indicate that, over long periods, the return on stocks beats the return on bonds and cash, but the journey can be more volatile.

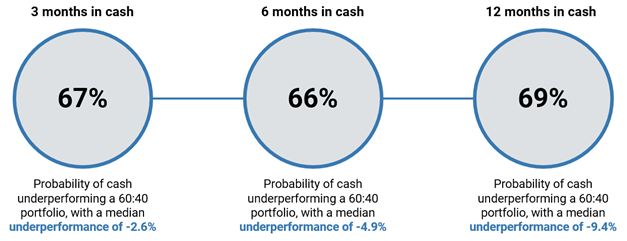

Using a portfolio to outperform the return on cash involves taking risk. Over short time periods, it’s less likely that a portfolio will beat the return on cash, but it’s still favourable. Using data from 1990 to 2023, Vanguard looked at the returns of cash versus a standard 60:40 portfolio (60% stocks and 40% bonds). Their analysis shows that, over 6-month time frames, there is a 66% chance that a 60:40 portfolio beats cash. Over 12 months, there is a 69% chance.

Source: Vanguard

In fact, the longer the time period, the greater the likelihood that cash underperforms investment portfolios.

Yes, investing can be volatile, but we encourage clients to take a longer-term view when this is available and suitable for their circumstances.

Take, for instance, £1 million invested in global stocks over 20 years, as shown in the chart below:

If you invested £1 million into an MSCI World tracker (an index that tracks global stocks) 20 years ago, it would be worth over £6 million now (in nominal terms i.e. before being adjusted for inflation). [7] It won’t have escaped your notice that the last 20 years have been quite volatile, most notably the Great Financial Crisis in 2008 (when stocks fell about 40%) and Covid in 2020 (when stocks fell about 30%), but there always seems to be something; be it Brexit, trade wars, actual wars, banks collapsing, and bubbles popping. But patient investors have been handsomely rewarded despite those concerns.

The above journey may have been too volatile for many, which is why we always assess an individual’s tolerance for volatility before making investment recommendations. We have a range of different portfolios with assets chosen to dampen the volatility and make the investment journey in-line with the client’s expectations.

How does this compare to bonds and cash?

The above chart shows the journey of £1 million invested into global stocks in red (MSCI World), bonds in blue (UK government bonds), and cash in green (using the Bank of England base rate + 1% as a proxy for cash). The differences after 20 years are startling:

| Value of £1m after 20 years | |

|---|---|

| Global stocks | £6,335,259 |

| UK bonds | £1,726,535 |

| UK cash | £1,725,923 |

Source: FE Analytics

Yes, there are times when cash beats other asset classes. But are investors able to adjust their own asset allocation to time when this will happen?

With all the information available to them, even highly experienced investment firms get this wrong. Timing the market can be very difficult. You’ll likely have heard the adage that investing is about “time in the market and not timing the market”. The classic saying never goes amiss when it comes to longer-term investing.

History can teach us a lot about investments and, as Mark Twain purportedly said, “History doesn’t repeat itself, but it often rhymes”. For almost a century, we have witnessed a number of market crashes and carefully studied the subsequent trends. Over time, markets have consistently rebounded from these dips, and those who profit the most from these situations are individuals who maintain composure and refrain from immediate reactions such as selling down the portfolio and crystallising losses.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

The outlook

2022 saw one of the worst performing years for both stocks and bonds, and the average investment portfolio performed poorly. However, we need to reframe our perspective and see that crises are inevitable. We are currently in a period of uncertainty which, for investors, can mean opportunity.

The bond market witnessed significant losses last year and, having avoided the worst of it, we have been buying bonds at a discount. Because the income stream on bonds is fixed (hence the term “fixed income”), barring the issuer (a government or company) defaulting, one can estimate the yield to maturity on bonds.

Developed market government bonds are offering yields of around 5%. High quality corporate bonds are yielding even more than this. High yield and emerging market bonds are currently yielding above 8% per annum in many places. These levels of returns from fixed income have not been seen from the asset class in over a decade and have been an increasing part of the Saltus portfolios.

Predicting the return on stocks is harder than with bonds because the income streams aren’t fixed. But if history does rhyme then, over long enough time periods, stocks should beat both bonds and cash.

What’s the conclusion?

Cash rates increasing is great news for investors. You should shop around for the best rates and maximise your coverage under the Financial Services Compensation Scheme. If you can’t handle the admin, then use a trusted third-party provider to assist you.

Seeking financial advice to help understand how much cash you should retain is always encouraged. For example, the tax gains this can result in can often far exceed the interest on cash, or the returns on investment portfolios.

For longer term capital, consider investing it, being mindful of how much risk you can afford to take, how much volatility you can tolerate, and when you need access to your money.

If in doubt, reach out to a qualified adviser who would be more than delighted to assist you.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.