A cashflow plan has the potential to be life-changing. Most of us wouldn’t set out on a journey to somewhere we’ve never been before without plugging a postcode into our sat nav or relying on an app for directions. Why then would you even consider retiring without first mapping out your journey from A to B? As well as providing you with a concept as to whether your retirement will ultimately be a comfortable one, cashflow plans can help you to make vital decisions with your money.

Cashflow planning – how to get started

To build an effective cashflow plan, you must always begin with a client’s goals. It’s crucial that enough time is taken to flesh these out. People are often only able to consider financial goals, and how to achieve them, in isolation. However, this approach can cause limitations. Understanding how all your financial objectives might interact together and when each may occur is key to determining whether you have enough money to achieve them all. Mapping them out within your cashflow plan will help you to understand if any goals need to be adjusted or re-prioritised. Businesses undertake this exercise on a regular basis to ensure success – it’s simply applying the same level of care and thought to your personal life as you might your working environment.[1]

Adding your existing assets and liabilities to your cashflow plan

Once you have a clear concept of what you want to achieve with your money, your adviser will take time to collate information on your existing assets, income and outgoings. They’ll want to understand exactly how much you have invested, what tax wrappers these assets are held in, and the value of your property, cars and other valuables. In addition, understanding your current level of income and immediate outgoings will help you to ascertain how much you can save on a regular basis into your pension and other investment pots. Finally, they’ll want to know the size of your mortgage and any other liabilities you may have, so that paying these down can be factored into your cashflow plan.

Technological wizardry – Cashflow planning tools

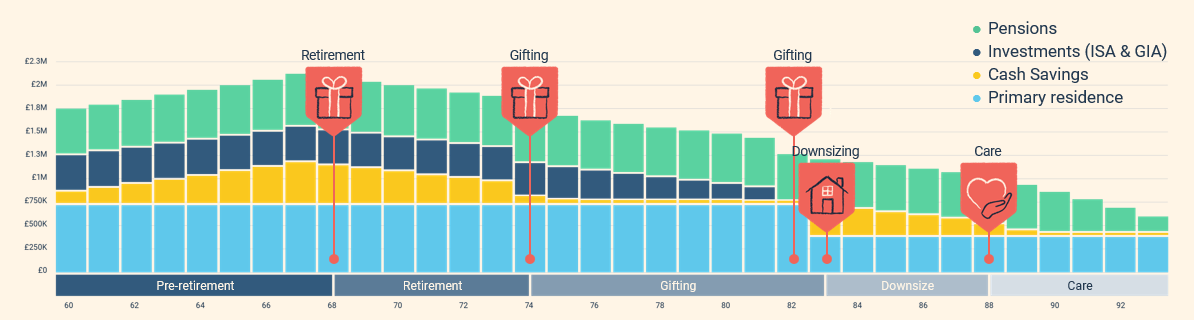

High-quality advice firms have access to sophisticated technology. Your assets, liabilities, regular saving plan and goals will be input into their cashflow modelling software.[2] These can be overlayed with different assumptions such as the level of long-term inflation and expected investment growth rates, to help establish if you have enough money to achieve all your goals. Most importantly, the software will provide a visual representation of your assets and how they may deplete over time to meet your needs. Furthermore, the cashflow plan will consider the most tax-efficient route to achieving your objectives and improve your chances of success.

A simple version might look something like this:

Exploring multiple scenarios in your cashflow plan

One of the greatest applications of a cashflow plan is the ability to create multiple scenarios, so that you can make financial decisions from an informed position. You should, for example, be able to explore areas such as the impact of retiring at different ages, changing the date you sell a property or the effect of taking more annual income in retirement than planned. It can be truly enlightening.

Stochastic modelling

Life can, of course, change and whilst a cashflow plan provides a phenomenal roadmap, nothing can accurately predict the future. Financial models will help you understand the probability of outcomes though. Once your assets have been input into the cashflow, you can then run your plan through a stochastic model.[3] This model looks at thousands of potential market environments that may unfold over the course of your retirement. Using this data, it is able to provide a probability level of how robustly your plan can weather possible storms. It provides extremely helpful insight into how realistic your assumptions are.

Do you need help with your retirement planning?

Our specialists can help you prepare for retirement and provide ongoing advice once retirement has arrived. Get in touch to discuss how we can help you.

Revealing financial freedom

Imagine how empowering being told the exact day you can realistically retire with confidence is.

Imagine knowing how much you can afford to gift to your children earlier than planned, without impacting your own lifestyle, and potentially avoiding inheritance tax as a result.

Imagine having a clear understanding of whether you can afford the holiday home you’ve always wanted, or being told you can spend more than you thought in retirement.

Information like this could well be life-changing and the most effective way of providing this guidance is likely with a cashflow plan. Of course, it’s not a one-time, quick fix solution and your cashflow plan should be revisited and adjusted regularly to allow for the changes life brings.

Regardless, it has the potential to be one of the most revealing and insightful financial exercises you can carry out. So, if you are approaching retirement and haven’t explored cashflow planning, it may be worth speaking to an adviser.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.