Given the extreme market volatility over the last few trading sessions, we wanted to provide an initial update on the Saltus portfolios and outlook, which we hope offers some clarity on the situation.

What has been happening in markets?

Following President Trump’s announcement of significant US trade tariffs on Wednesday 2nd April, stock markets across the world have fallen sharply as expectations for economic growth and corporate earnings have slowed.

In the weeks leading up to the tariff announcement, investors and market watchers weren’t sure what to expect. Riskier assets fell throughout March in anticipation of the announcement. Many were hoping for a simple structure, like a flat rate or a two- to three-tier system capped at 20%, and ideally the tariffs would be open to negotiation. When the announcement finally came though, the tariffs were more complex and much harsher than expected.

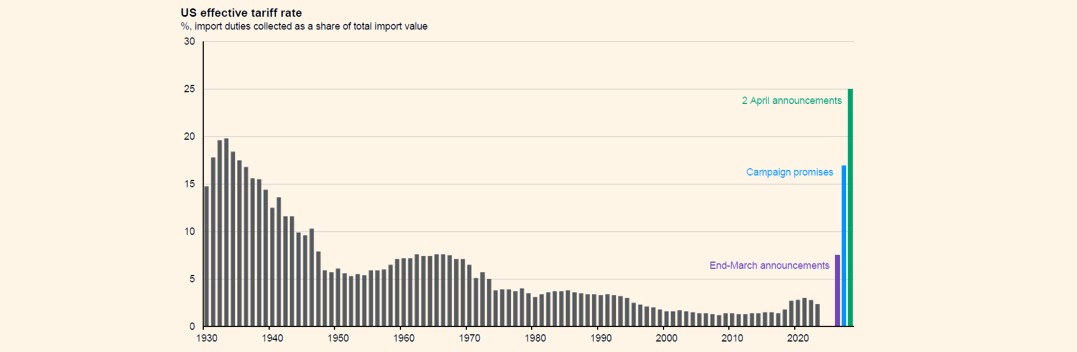

The selling in stock markets has been rapid and broad-based since then. Bond prices have risen as expectations for interest rate cuts have increased. Commodity prices have fallen as economic growth estimates have been revised down. The below chart (from the Cato Institute, US Department of Commerce & J.P. Morgan) highlights just how much larger the announced tariffs were than both history and recent expectations.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

Whilst it is too early to determine what the long term consequences of these measures will be for economies and financial markets, we are assessing the impact on portfolios and reviewing opportunities emerging from the market turmoil. We are confident that the core principles of the Saltus investment approach of broad diversification, a high degree of liquidity, and a long term mindset will help our clients navigate through this period of acute uncertainty.

What has been happening in portfolios?

Given the wide range of portfolios that we manage, we can’t give exact clarity on portfolio performance, but broadly speaking, clients in our lowest risk portfolios will likely be flat or slightly negative for the year so far (to 7th April 2025). Given the fear-inducing headlines, these numbers are pleasing to see, especially as the holders of these portfolios are those clients with the shortest time horizons and the lowest ability to take risk.

The highest risk portfolios have fallen less than the global stock market (as measured by the MSCI All Country World Index), which has fallen around 13% over the year so far (to 7th April 2025). Medium risk portfolios have also held up well, with the multi asset approach offering a number of offsets to the equity market losses. It is important to recognise that the largest drawdowns have been felt in portfolios designed to take the most risk. Saltus clients can refer to the client portal for more specific information on their portfolios.

Whilst we never want to see our client portfolios post negative numbers, market volatility is part and parcel of investing. Hopefully, the above adds both some colour, and a more stable picture compared to the headlines that have been circulating.

What is the outlook from here?

Although it is very hard to see the current uncertainty dissipating soon, markets have moved a long way in a short period of time. The impact and ultimate level of tariffs are hard to calculate given the number of moving parts, but there are already green shoots for risk assets appearing. Over the last 24 hours we have seen positive news flow in the form of trade negotiations (in Japan, for example) or fiscal response (reports suggest China are considering front loading their stimulus in response to tariffs). What we do know is how markets have responded historically to drawdowns and similar periods of stress.

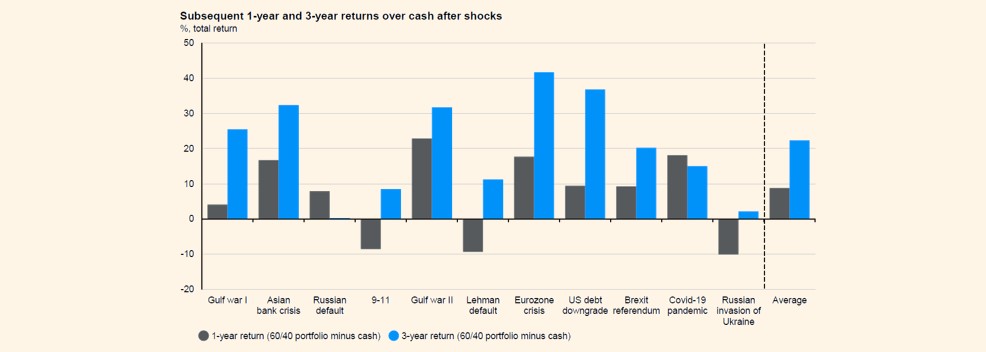

The below chart, sent to us by the research team at JP Morgan, highlights the fact that a traditionally invested stock and bond portfolio has, on average, delivered consistent outperformance over cash in the following 1 and 3 years after a market shock. Although we invest in many asset classes other than just stocks and bonds, the chart reminds us that market pull backs such as this tend to offer good buying opportunities for long term investors. We are currently assessing a number of opportunities and reviewing our existing portfolio themes that have become more attractive as a result of the recent volatility.

Our core aim at Saltus is to build highly diversified portfolios to reduce volatility and maximise risk-adjusted returns. This is because we recognise markets are inherently uncertain. We do not claim to have any enhanced insights or edge on what the outcome of this extraordinary period will be, but we have invested through uncertain and volatile periods before and the basic principles of our investment process don’t alter with news flow, however eye-catching it may be.

Where can I get more information?

If you would like more information on the team’s current views, you can watch this video (Q1 2025 Investment and tariffs update) or speak to a Saltus adviser. We will be keeping you updated as events unfold.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.