Despite our best efforts, many Saltus portfolios finished 2022 below where they had started. We know losses are never welcome, but we are content that our processes and philosophy helped client portfolios weather the storm through what was a challenging year. Our strategies finished the year significantly ahead of most competitor portfolios. In fact, our flagship portfolio range sits in the top 25% of the industry for every risk profile over one, three, five and ten years, as judged by an independent firm. Certainly, a difficult year, but at least relatively positive in comparison to our peers.

What follows is a quick review of 2022. We outline the key investment themes and the major decisions that affected performance – both the successes and the failures. We finish by discussing the outlook for 2023 and how we’re positioned at the time of writing (February 2023).

2022: financial markets

We entered 2022 with economies continuing to re-open from lockdowns but, with supply chains still stretched, this was inflationary. Then Russia invaded Ukraine. The West responded with sanctions, arms, and funding. The war turbo-charged the inflationary pressures because it acted like an additional supply shock, on top of the pre-existing Covid supply shock. Energy prices soared, with oil rising to nearly $140 a barrel. The prices of essential foods also rocketed, leading to civil unrest in many countries. Inflation reached double digits in some areas.

Britain saw two monarchs, three prime ministers, and four chancellors in 2022. The Kwarteng-Truss mini-budget caused mayhem in the government bond market, and the Bank of England had to step in to provide support, with several large pension funds narrowly avoiding collapse.

Further afield, President Biden approved $500 billion of new spending and tax breaks aiming to boost clean energy and reduce healthcare costs. Xi Jinping broke precedent by securing a third term as leader of the Communist Party, and his zero-Covid policy was all but abandoned after protests against Covid restrictions.

2022 saw a dramatic shift in the economic regime, moving from historically low inflation and interest rates to double digit inflation and rising interest rates, at a time when the financial system had never had so much debt, and liquidity was being squeezed out of the system. Markets did not like the transition.

Stock markets fell around the world. Bonds also fell, which is an issue because they’re often relied upon to increase in value when stocks fall, thereby providing some protection to multi-asset portfolios. In fact, it was one of the worst years on record for a traditional medium risk portfolio of 60% shares and 40% bonds.

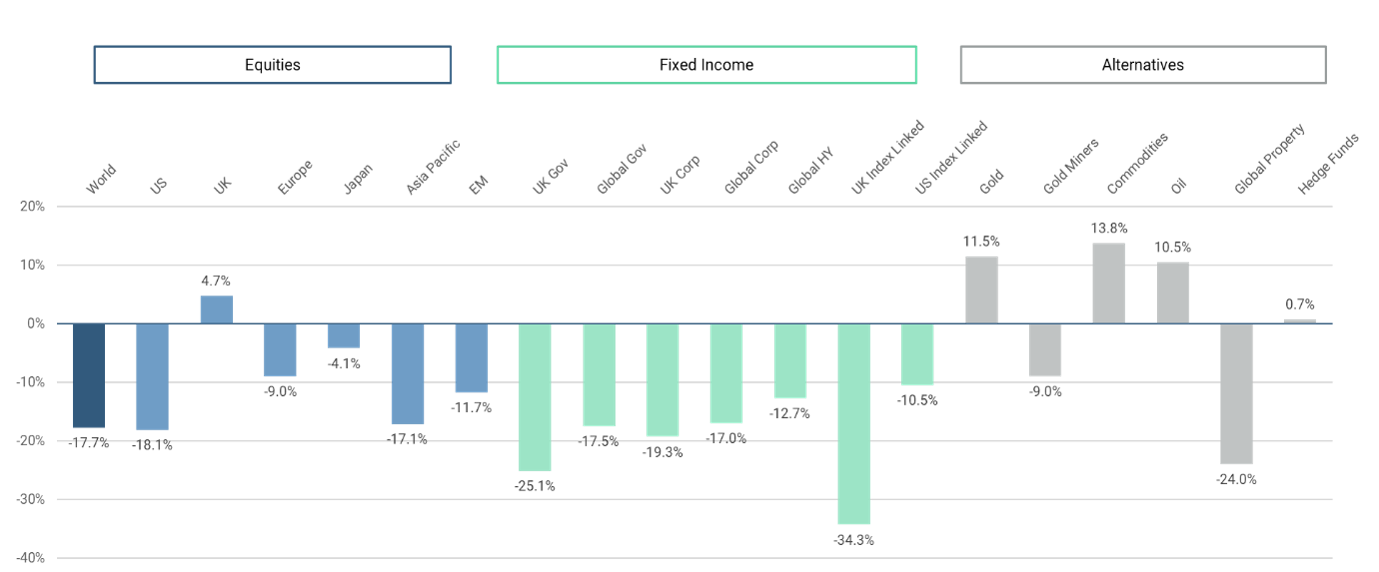

The above chart shows the returns of major asset classes ignoring currency impacts, equities/stocks in blue, fixed income/bonds in green and everything else in grey. Global stocks (with the £ fully hedged) fell over 20% by October before finishing the year about -18%. Global bonds didn’t fare much better; UK government bonds were hit particularly badly, losing about 25% in 2022. We’re pleased to report that our portfolios held up significantly better than this, even if many did finish the year in negative territory.

Do you need help managing your investments?

Our team can recommend an investment strategy to meet your financial objectives and give you peace of mind that your investments are in good hands. Get in touch to discuss how we can help you.

2022: how Saltus fared

Saltus manage a range of portfolios for investors; some clients constrain our asset allocation decisions to reduce the cost or because they don’t believe in active management as a concept. What follows is a description of how Saltus managed portfolios without such restrictions.

Equities

Unlike many of our UK based competitors, we don’t have a home bias in our portfolios, and we began 2022 with much lower exposure to UK small and medium sized companies than many of our peers. This was helpful because these were some of the worst hit globally, even if the FTSE 100 held up well.

During 2021, we took profits on many of the growth-oriented technology-based stocks that had served us well since Covid (but were looking expensive and vulnerable to interest rate rises). Instead, we tilted our stocks towards far cheaper (“value”) companies, which then outperformed. In fact, observing a global stock index, “value” stocks out-performed “growth” stocks by over 20% in 2022, so tilting portfolios away from growth stocks and into value stocks in 2021 was particularly helpful.

Mindful of a worsening economic outlook through 2021 and into 2022, we had been increasing the “quality” of our stocks. Compared to the average stock, quality stocks tend to generate lots of cash, have low debt to income ratios and, because of their strong pricing power, they find it easier to protect their profitability when inflation rises. This leaning towards quality was very helpful through 2022.

However, we didn’t get everything right. Our largest geographical exposure was to the US, which had performed incredibly well until 2022 when it underperformed global stocks. Additionally, whilst we correctly titled our stocks away from “growth” and into “value”, we still had positions with growth managers who went on to have a tough year in 2022 after many years of outperformance. Equities were down in most major regions around the world so, as global investors, it was a very difficult environment to be invested in, but the changes we made were very helpful in preserving capital for our clients.

Bonds

Bonds had been getting increasingly expensive post-Covid. In 2021, they were so expensive that we felt they didn’t offer much upside at all, in terms of yield or capital appreciation. Certainly not enough upside to make us comfortable with their potential downside. Interest rates were at rock bottom historically and, with inflation pressures rising, we recognised that interest rates may need to rise, and we suspected that bonds would suffer serious falls if they did. So, in 2021 we got rid of all of our traditional government bonds in anticipation, even in low-risk portfolios (where they would naturally have a large allocation due to their perceived safety in normal times).

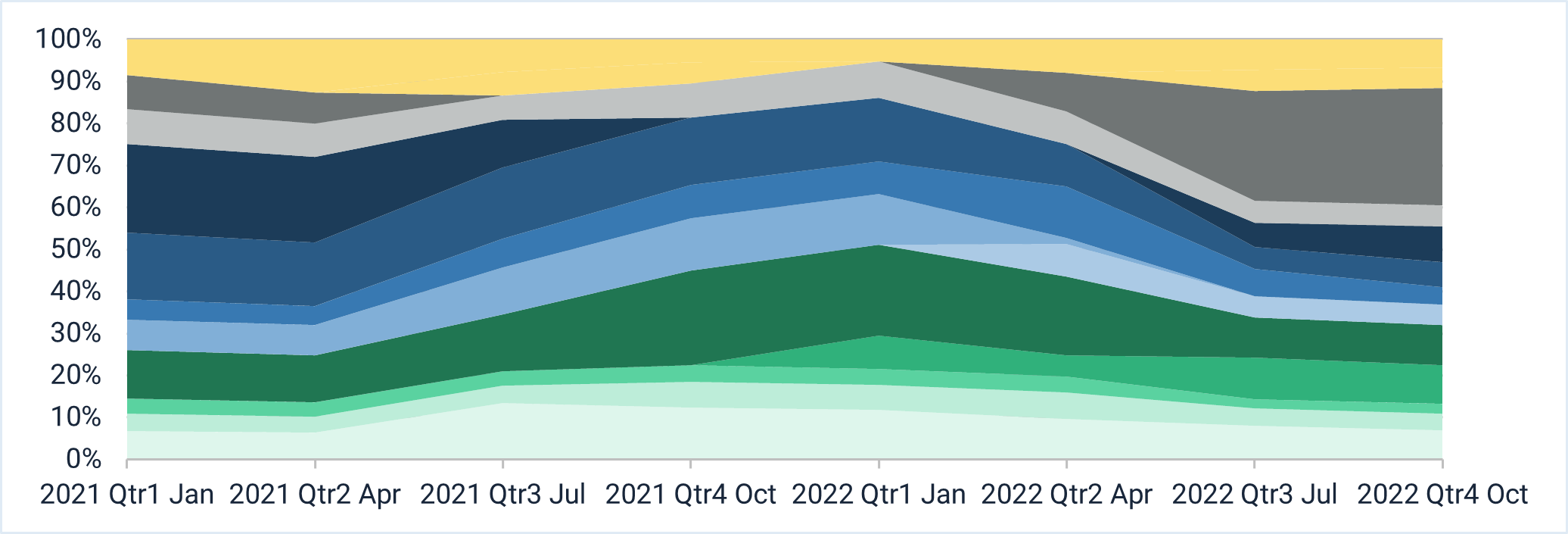

The below chart shows the allocation of different types of fixed income bonds that we held. It starts in 2021 and finishes in the fourth quarter of 2022. You can see how active we were in managing our fixed income exposures away from government bonds (dark grey) and investment grade corporate bonds (dark blue), favouring alternative fixed income (green).

2022 was one of the worst years on record for bonds. UK government bonds (gilts) fell 25%. US government bonds (treasuries) fell 12.5%. When bond prices fall like this, their yields rise. Once the yields rose to an attractive level, we began buying US treasuries, seeking safety in the US dollar, and securing good yields on the US government bonds. As you can see from the above chart, government bonds (dark grey) now make up the largest part of our fixed income exposure.

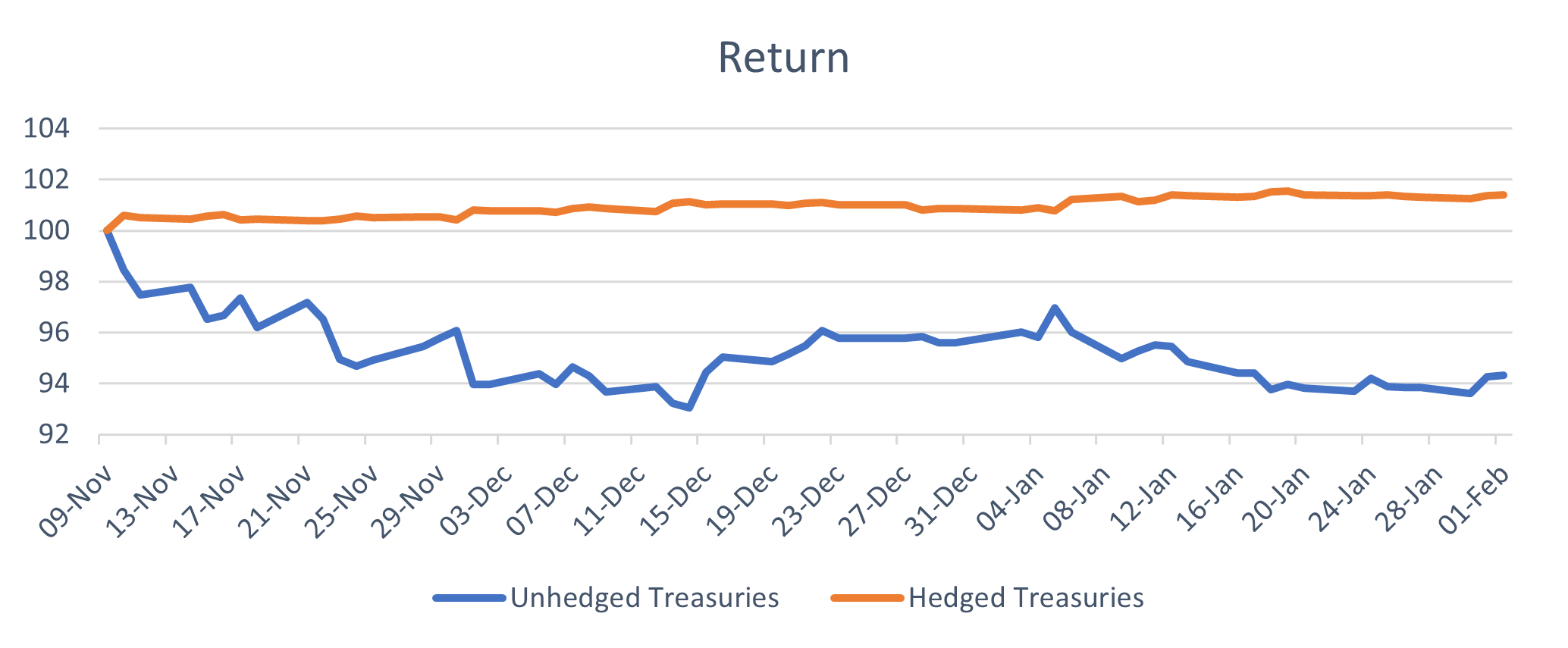

In November, we decided we no longer wanted such high exposure to the US dollar on our US treasuries. The US dollar had risen so strongly in the year already that we felt further upside in the dollar was likely to be minimal. There was also potential for some serious losses if the US dollar reduced in value, which is what happened. The chart below shows the return on our US treasuries once we decided to hedge the currency risk. The orange line shows the return our investors received (positive returns because we hedged the currency risk) versus the blue line, which shows what would have happened had we not hedged the currency risk in November. Whilst Saltus are certainly not currency traders or speculators, we are aware of currency risk as it impacts returns and we will take a view on the currency when our conviction is high enough.

However, we didn’t get everything right. Whilst we sold our traditional government bond exposures, we held onto our index-linked bonds, which came under pressure last year. Additionally, convertible bonds fell aggressively over January and February 2022. Given the size of the falls, we thought we had found a good entry point and we made an investment into convertible bonds. We were proven incorrect as convertible bonds continued to fall, detracting from performance in 2022.

Overall, bond markets had one of their worst on record, but our investors managed to avoid the worst of it, and we believe there are now significant opportunities in fixed income/bonds.

Alternatives

Saltus has long held allocations to alternative investment strategies such as global macro hedge funds, long short equity funds (who can make money whether markets go up or down), and gold. We did not see value in government bonds, so we entered 2022 with significant exposures to alternative investment strategies. In a year when both equity and bonds fell together, our allocation to alternative investments was very helpful for protecting capital.

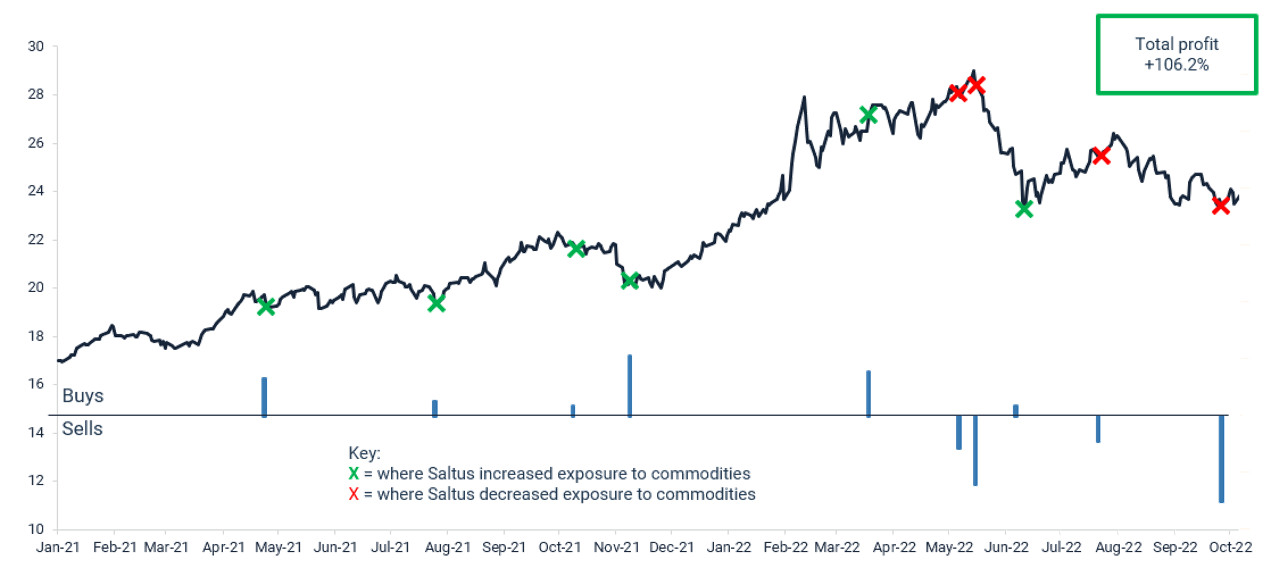

As part of our exposure to alternatives, throughout 2021 we built a position in commodities, which we saw as an effective way to increase inflation protection within portfolios. You can see how effective this was by looking at the below chart. The black line shows the price of the instrument we used. The green crosses indicate where we increased exposure to the instrument, the red crosses show where we reduced exposure. The bars under the crosses indicate the size of the trades we made.

By early 2022, the position in commodities was already performing well and, when Russia invaded Ukraine, the positive returns continued. In the second quarter of 2022, we became concerned that the potential downside of holding commodities (from fears about recession, which is typically bad for broad commodities) exceeded the potential upside, so we halved the position in May – very close to the top of the market. We then liquidated the rest of the position over the following months. In total, the position generated a profit of 106.2%. This was a significant positive contributor when losses were negative across many other asset classes.

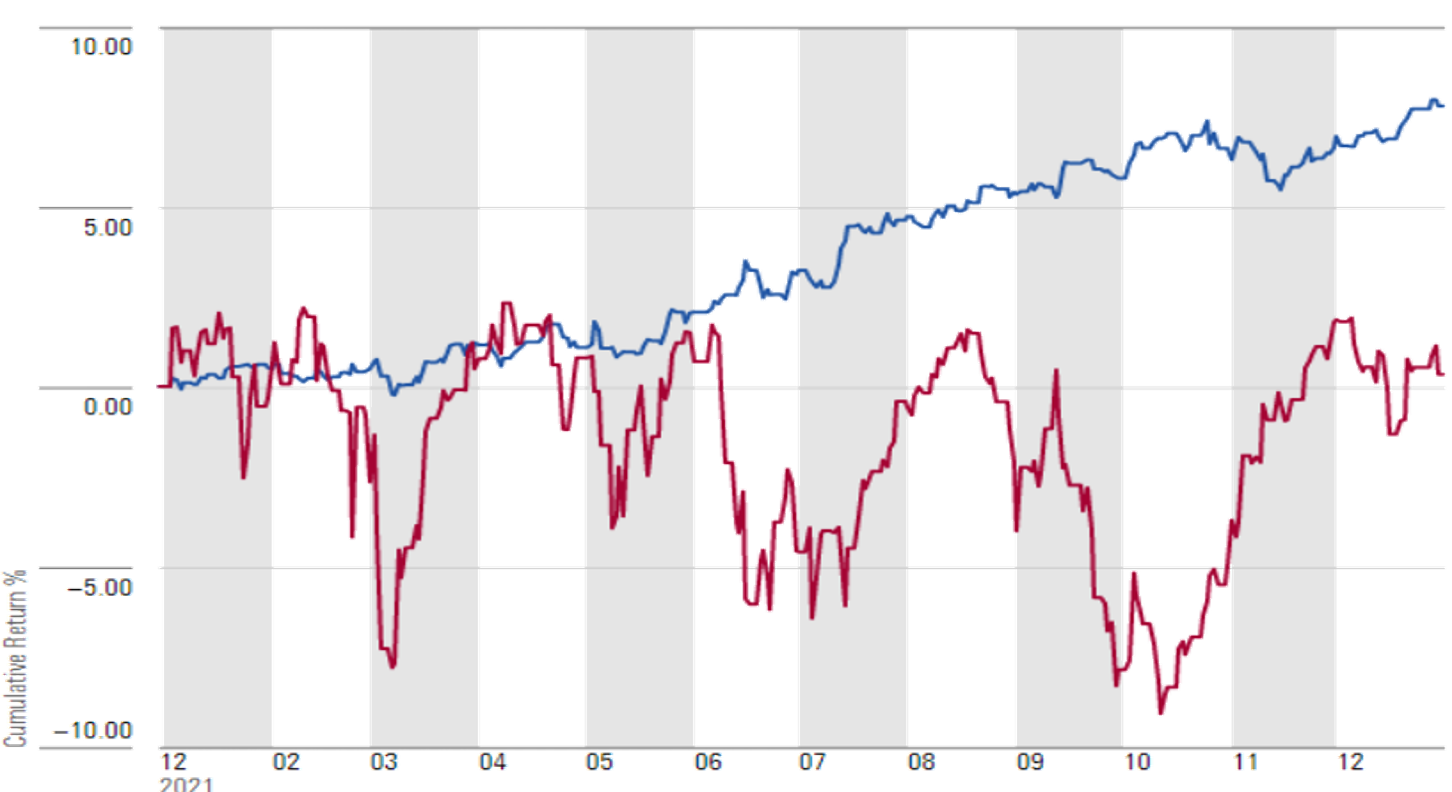

At the start of 2022, we decided to include a long-short equity manager to portfolios. This is a style of investing that can generate positive returns whether stock markets go up or down. It was pleasing to see this new addition to our portfolios perform well in 2022, finishing +7.8%. Because we invested early in the fund’s life, we managed to secure a significant discount for our investors. The chart below shows how the fund Tellworth UK Select (blue) performed against UK stocks, as shown by the FTSE All Share (red), over 2022.

Source: Morningstar

However, we didn’t get everything right. For diversification, we held multiple macro hedge fund strategies and, whilst one of them did extremely well in 2022 (+20%), some of the others didn’t do so well, outperforming global stocks and bonds but posting negative numbers.

Looking ahead

Weighing up the outlook, on the negative side equities and bonds continue to move in the same direction which increases the likelihood of a coordinated sell-off in markets, which is one of the reasons we continue to focus on alternative investment strategies. Economic growth is slowing across the world and is negative in some areas. The bond market is still pricing for US interest rates to peak lower and earlier than the Federal Reserve is guiding, a situation we found ourselves in at least twice in 2022 and which ended badly both times.

The effects of interest rate rises are beginning to show, but they haven’t been fully felt yet because 1) the rate rises haven’t finished yet and 2) there’s a lag between when interest rates rise and when growth slows. Corporate profits have been falling, and many leading economic indicators such as PMI levels, housing data, manufacturing production & exports, point to an impending recession.

On the more positive side, we have seen some very strong economic data this year, such as retail sales and jobs reports far exceeding expectations in the US, where the labour market appears to be particularly strong.

In China, they have essentially ended their zero-Covid policies, which is welcome since that supports global growth (although we are wary of China’s property market and lack of new growth model). Global liquidity, a key driver of asset prices, has picked up significantly, boosted by the central banks of China, Japan, and Europe.

Additionally, there is evidence that inflationary pressures across developed economies have peaked and have begun to decline. In fact, there is outright deflation visible across the manufacturing goods sector, and energy prices have fallen sharply.

Some asset classes are now trading at attractive valuations, implying good long-term returns, for those brave enough to tolerate the volatility.

Overall, Saltus are relatively cautiously positioned, not using up all of our risk budgets in our different risk profiles. We have enough risk on the table to participate in market rallies that continue to happen, but we feel we have adequate protection to soften the impact of any sell-offs. We remain vigilant for changes in the environment and will take action accordingly.

With thanks for your continued support,

The Saltus Asset Management Team

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.